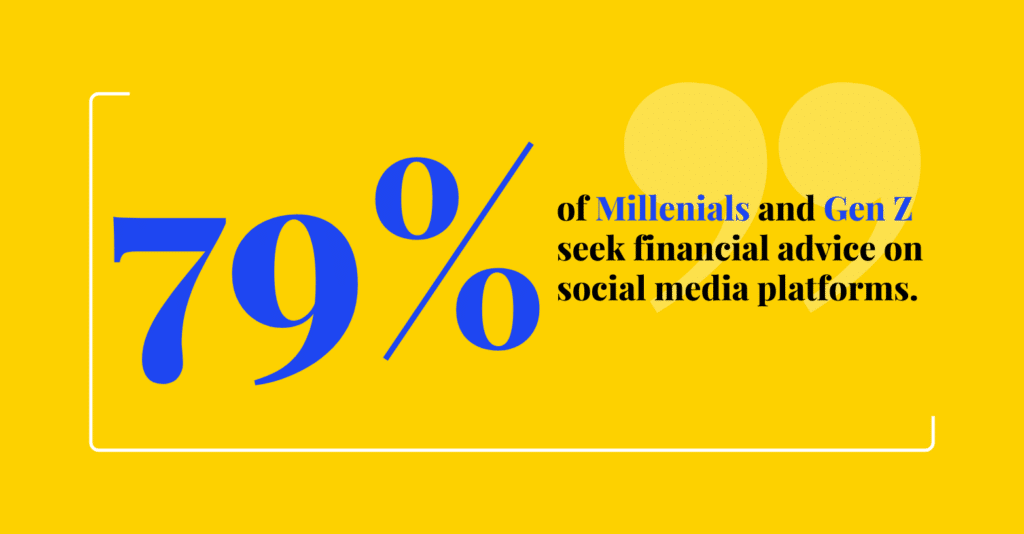

Marketing financial services to Millennials and Gen Z presents both unique challenges and incredible opportunities. These digitally savvy generations demand more from brands—more transparency, more accessibility, and more engagement. With 79% of Millennials and Gen Z seeking financial advice on social media platforms like TikTok, financial institutions must adapt their marketing strategies to compete in an environment where information is not only abundant but also often unreliable. Navigating this space requires a deep understanding of evolving consumer preferences. For instance, 51% of consumers aged 18-24 and 49% of those aged 25-34 now trust FinTech brands over traditional banks.

At Session Interactive, we help financial services companies craft marketing strategies that resonate with younger demographics. We know firsthand the challenges of reliance on mobile apps, hunger for financial literacy, and skepticism toward traditional financial institutions. We specialize in creating campaigns that cut through the noise and deliver measurable results.

Our experts have gathered these 9 actionable strategies, backed by data, to help financial brands stay ahead and thrive in the digital-first era.

1. Embrace New Technologies

For Millennials and Gen Z, convenience isn’t just a preference—it’s an expectation. These generations have grown up in a digital-first world, where everything from shopping to entertainment is instant and intuitive. Their approach to financial services is no different. An overwhelming majority, 84% of Gen Z and 82% of Millennials, expect to manage all their banking needs through mobile apps, reflecting a major shift towards app-based banking. What’s more, 60% of these consumers are willing to switch providers for a better app experience, signaling that seamless, user-friendly technology is more than a competitive advantage—it’s a necessity.

This shift in consumer behavior underscores why financial institutions must prioritize technological innovation. It’s not just about meeting expectations; it’s about staying relevant. From mobile banking apps and digital wallets to AI-driven financial tools, adopting the latest technologies enables financial service providers to streamline operations, improve user experience, and foster deeper customer loyalty. Banks and fintech companies that resist this evolution risk losing a massive segment of the market to competitors who understand the tech-savvy mindset of younger consumers.

Provide Online Account Management

Younger people prioritize convenience and accessibility in their interactions with financial institutions, making digital-first solutions a core expectation. Tools like mobile apps that allow users to track their spending, create savings goals, or even manage investments in real-time simplify financial management and foster a sense of control over their money. This aligns perfectly with the preferences of younger consumers who are digitally savvy and value seamless, on-the-go account access.

Offering robust online account management tools, financial institutions can enhance customer satisfaction, build loyalty, and remain competitive in a market that increasingly values user-friendly digital experiences.

Offer Digital Product Signups

Enabling digital product signups streamlines the customer experience, eliminating friction in the early stages of the customer journey. This seamless approach leads to higher conversion rates as prospects can quickly open accounts, apply for credit cards, or explore other financial products with just a few clicks.

For example, companies like Chime and Capital One have optimized digital onboarding to meet these expectations. Chime allows users to sign up for an online checking account in minutes through its app, requiring only basic information and no hidden fees. Likewise, Capital One offers a fully digital credit card application process where users can receive instant approval. By simplifying access to financial products, these institutions enhance user satisfaction and capture the loyalty of digitally-minded consumers.

Automate Customer Service

AI-powered chatbots and virtual assistants improve response times while reducing operational costs. By handling routine inquiries, such as FAQs about account balances or transaction statuses, automated systems free up human representatives to focus on more complex customer concerns.

Examples of successful automation are abundant. For instance, Bank of America’s virtual assistant, Erica, goes beyond basic queries by offering spending insights, bill reminders, and even credit score updates to users through its mobile app. Similarly, companies like PayPal deploy chatbots to quickly resolve disputes and guide users through account processes. These tools enhance the efficiency of customer interactions and demonstrate a commitment to innovation.

2. Leverage Data to Drive Marketing Actions

Financial services companies sit on a wealth of valuable data, often untapped or underutilized. From demographic details to behavioral insights, this treasure trove of information gives companies a deep understanding of their customer base. Demographic information uncovers trends related to age, income, and geographic location. Behavioral insights, gathered through digital tools like apps and websites, highlight preferences in financial products and user engagement levels. Together, this data provides the foundation for smarter, more targeted marketing strategies.

Data-driven strategies underpin customer retention efforts, such as loyalty programs designed to reward frequent interactions or long-term engagement. Financial brands that adopt data-focused decision-making enhance their marketing ROI and cultivate stronger, more personalized relationships with their customers.

Optimize Products and Services

Using customer data to refine financial products and services is a smart strategy. Analyzing patterns in spending, saving, and borrowing helps marketers tailor their offerings to meet the specific needs of their target audience. For example, if customer data indicates a growing demand for better financial literacy tools, a bank could introduce budgeting features within its app that help users track their expenses and set savings goals. This addresses a clear need and strengthens the customer relationship by offering practical solutions.

Identifying gaps in the market is another advantage of leveraging customer data. Credit card companies, for instance, have successfully launched customized rewards programs based on users’ spending habits. A provider might introduce cash-back perks for everyday purchases like groceries or fuel if data shows that’s where users spend most frequently. These personalized services help businesses align their products with customer expectations, ultimately enhancing satisfaction while driving growth and loyalty.

Create Detailed Customer Personas

By creating personas based on data like age, income, goals, and behaviors, you can better understand and target your audience. This approach allows marketers to craft content and campaigns that feel personalized and relevant. For example, segmenting customers into groups such as “young professionals saving for a home” or “retirees focused on wealth preservation” enables the creation of tailored messaging and tailored financial solutions that resonate with those distinct needs.

This level of specificity improves marketing conversion rates and strengthens customer relationships. Consider a campaign offering first-time homebuyers educational resources and mortgage products or wealth management initiatives catering to retirees’ priorities like low-risk investments.

Aligning campaigns with the values and priorities of each persona, financial brands ensure their marketing feels thoughtful and personal, fostering trust and loyalty while driving better results overall.

Measure Performance and Attribution

Tracking marketing performance and attribution is crucial for financial services firms seeking to optimize their strategies and maximize ROI. This will help them identify which channels deliver the best results and allocate budgets more effectively so that resources are invested where they have the most impact.

For example, analytics tools can reveal that social media ads generate higher engagement and conversions than email campaigns, prompting a shift in strategy to prioritize those platforms. This data-driven approach provides clarity on what works and what doesn’t, enabling continuous improvement.

Another key benefit is understanding customer journeys through attribution tracking. By mapping interactions, such as website visits, app usage, or in-branch consultations, marketers can pinpoint the touchpoints that lead to conversions and refine their efforts accordingly. For instance, if data shows that most customers engage with a blog post before signing up for a service, it highlights the value of content marketing. Measuring and attributing performance not only sharpens campaign effectiveness but also reinforces transparency in marketing decisions, ensuring every dollar spent delivers meaningful outcomes.

3. Educate Your Target Audience with Content Marketing

Financial services are complex and often daunting for consumers. The intricacies of navigating investment options, understanding loan terms, or planning for retirement can leave many feeling overwhelmed. This creates an opportunity for financial service companies to step in as trusted educators. Simplifying these topics and delivering information in digestible ways, empowers your audience to make confident financial decisions.

A multichannel content marketing approach is key to achieving this. Use blogs to break down financial jargon, videos to provide step-by-step guides, webinars to host Q&A sessions with experts, and social media to share quick tips and resources.

For instance, a bank might post Instagram reels explaining how compound interest works or create a full-scale webinar series on budgeting basics for Millennials. By tailoring content to specific platforms and demographics—such as younger audiences on TikTok and more seasoned consumers via email newsletters—financial brands ensure their message resonates widely. These comprehensive efforts reinforce trust and establish the company as a credible source of financial literacy, all while fostering stronger customer relationships.

Create and Deliver Content Based on Audience Segmentation

Tailoring content to specific audience segments is one of the most effective ways financial services can improve engagement and relevance. By using customer data to understand the distinct needs, goals, and preferences of different demographic groups, you can craft messages that truly resonate. For example, a retirement planning firm might develop in-depth guides focused on wealth preservation for older audiences, while targeting younger professionals with quick, actionable budgeting tips designed to help them tackle student loans or save for their first home.

Segmentation ensures the right message reaches the right audience through the appropriate channels, maximizing impact. A campaign aimed at retirees might perform best through email newsletters or physical mailers, whereas younger segments are more likely to respond to Instagram or TikTok content. This level of precision not only boosts engagement but also strengthens customer trust, as audiences feel understood and valued. Ultimately, audience segmentation brings clarity and focus to content marketing, ensuring every resource serves a clear purpose.

Build Interactive Learning Tools

Interactive tools are a powerful way for financial services to engage and educate their audience. Resources like calculators, quizzes, or simulators provide a hands-on learning experience that simplifies complex concepts and promotes informed decision-making.

For example, a mortgage calculator allows potential homebuyers to estimate monthly payments based on loan terms, giving them immediate clarity during a stressful process. Similarly, a retirement savings simulator can help users visualize their financial futures, making long-term planning feel achievable and personalized.

These tools enhance the user experience and position the brand as a helpful and trustworthy partner in their financial journey. Customers appreciate actionable resources that bring value and tangibly improve their understanding of financial matters. By leveraging these interactive elements, companies show they are invested in their customers’ success, fostering deeper relationships and long-term loyalty.

Use Storytelling to Simplify the Complex

Storytelling is a powerful tool for making complex financial topics more relatable and engaging. You can weave narratives around abstract concepts to demystify intimidating subjects and create meaningful connections with their audiences. For instance, sharing customer success stories—such as a young family using smart budgeting to save for their first home—makes financial strategies feel achievable and inspiring. Similarly, using analogies like comparing investment diversification to a well-balanced meal simplifies tricky ideas, transforming them into something tangible and memorable.

This approach enhances understanding and builds emotional connections. A compelling story humanizes the numbers and charts, turning financial goals into lived experiences. Customers are more likely to trust and connect with a brand that presents information in a way that feels personal and approachable. Through storytelling, financial services can communicate expertise while fostering loyalty and empowering clients to take charge of their financial journeys.

4. Extend Value with Email Marketing Campaigns

Email marketing offers financial service companies a direct and effective way to provide additional value to their audience. By sharing educational content, companies can guide customers toward smarter financial decisions, breaking down complex topics into digestible insights. For instance, sending a monthly newsletter with articles on budgeting tips or steps to improve credit scores not only keeps your audience informed but also positions your business as a trusted source of financial expertise. This regular communication builds long-term engagement and shows that the company is invested in the well-being of its customers.

Email campaigns can deliver exclusive insights and tailored recommendations that feel personal and relevant. Updates on market trends or advice on investment opportunities can help customers stay ahead, while personalized recommendations, such as suggesting credit cards based on spending habits, demonstrate a deeper understanding of their needs.

These approaches help foster trust, strengthen relationships, and ultimately position the brand as a valuable partner in their financial journeys. When done thoughtfully, email marketing transforms communication into a meaningful exchange, benefiting both the business and its audience.

Provide Market Insights and Financial Updates

Sharing timely market insights and financial updates through email marketing keeps customers informed and positions financial service companies as reliable sources of expertise. For example, weekly updates on stock market trends, changing interest rates, or economic forecasts can help customers make more informed decisions about their investments or financial plans. These insights empower audiences with knowledge and demonstrate the company’s commitment to staying ahead of industry developments.

Regular updates foster trust and strengthen the relationship between a brand and its customers. A well-crafted email detailing how current market changes might impact retirement funds or mortgage options shows a clear understanding of customer concerns and needs. By delivering valuable, actionable information directly to their inboxes, companies reaffirm their role as essential partners in their financial journeys, encouraging long-term loyalty.

Deliver Timely Resources and Incentives

Using email to share timely resources and incentives can help you stay organized and take action when it matters most. For instance, you might receive reminders about tax deadlines with links to tools or guides that simplify the process. Or you could get exclusive, limited-time offers, like lower rates on loans or rewards for signing up for a new credit card, which encourage you to act quickly.

This approach shows that your time and needs are valued. When a company provides helpful resources or well-timed offers, you know they are invested in your success. These efforts build trust and loyalty, while giving you practical benefits and opportunities to reach your financial goals.

Connect with Personalized Offers and Invites

Personalized offers and invites show your customers that you see them as individuals, not just account numbers. By tailoring these communications to specific needs, you can create a stronger bond with your audience. For example, you might send investment opportunities that align with a customer’s portfolio or invite them to exclusive financial planning webinars that match their interests. These thoughtful gestures make your services feel relevant and meaningful.

When you take this personalized approach, your customers feel valued and understood. It shows that you’re paying attention to their goals and challenges. This level of care builds trust, encourages engagement, and sets your brand apart as a partner in their financial success.

5. Enhance Your Visibility with SEO

Search engine optimization (SEO), implemented with the expertise of an SEO agency, is a powerful way to boost your brand’s visibility and attract the right audience. Focusing on relevant keywords that align with what your target customers are searching for ensures your website appears when it matters most.

Beyond keywords, creating high-quality content is critical in improving your rankings. Articles, guides, and videos that offer clear, helpful advice boost your site’s chances of appearing in search results but also position you as an authority in the financial space. Pair this with a fast, user-friendly website, and you’re more likely to keep visitors engaged, build trust, and encourage them to explore what you offer.

Using SEO effectively helps you connect with the right people while increasing your credibility. It’s a long-term investment that brings more organic traffic to your site and makes it easier for potential clients to find you when they need financial expertise. By enhancing your visibility, SEO puts your company in a stronger position to grow and succeed.

Build Trust and Credibility with EEAT

Building trust and credibility starts with demonstrating your expertise, authoritativeness, and trustworthiness (EEAT). You can do this by sharing expert-authored articles on complex topics, like retirement planning or market trends, that add real value to your customers. Highlighting certifications or awards prominently on your website, paired with an effective SEO strategy, also underlines your authority in the field. And don’t forget to include customer testimonials—positive experiences from others reinforce your reliability.

When you use EEAT effectively, you give customers confidence that they’re in good hands. This approach not only strengthens your brand reputation but also sets you apart as a financial partner who is knowledgeable, transparent, and dependable. It’s a simple but powerful way to build lasting trust.

Target Long-Tail Keywords with Financial Intent

Targeting long-tail keywords with financial intent, combined with a well-planned SEO strategy, helps you reach a more specific and motivated audience. These are phrases that go beyond generic terms, showing clear intent and interest. For example, someone searching for “best credit cards for travel rewards” or “how to save for a down payment” is likely looking for actionable information or solutions. By optimizing your content around these targeted phrases, you can connect directly with people who are closer to making a decision.

This approach improves your search rankings by reducing competition for more niche terms. It also drives qualified traffic—users whose needs align with your services. Because you’re addressing their specific goals and concerns, you’re more likely to see high engagement and increased conversions. Long-tail keywords don’t just bring visitors; they bring the right visitors, setting your business up for stronger results.

Grow Your Brand Awareness

Growing your brand awareness ensures that more people recognize and trust your financial services. When you stay visible and consistent, you make it easier for potential customers to think of you when they need help. Social media campaigns, for example, can showcase your expertise while reaching a broader audience. Partnerships with trusted organizations or hosting educational webinars can also put your name in front of the right people and build your reputation as a reliable resource.

The more visible your brand becomes, the more you attract new customers and encourage loyalty from current ones. Consistent messaging across channels reinforces your expertise and values, making you a stronger presence in the financial services market. By actively growing awareness, you position yourself as a dependable partner that clients can rely on for their financial goals.

6. Generate Leads and Insights with Paid Advertising

Paid advertising, managed effectively by a PPC agency, is a powerful way to connect with your target audience and generate new leads for your financial services. With options like pay-per-click (PPC) ads, display ads, video, and social media campaigns, you can reach prospects where they spend their time online. PPC, for instance, allows you to drive traffic to specific landing pages by targeting keywords that align with customer intent, like “best mortgage rates” or “retirement savings plans.” Meanwhile, engaging video ads can simplify complex financial concepts, making it easier for clients to understand your offerings.

The beauty of paid advertising lies in its precision and measurability. You can target people by demographics, geography, interests, and even behavior, ensuring your ads are seen by those who are most likely to convert. Plus, every campaign provides valuable insights into which messaging and formats work best—data you can use to optimize other marketing channels. For example, running a series of display ads could reveal which financial products spark the most interest, helping you refine your email or content marketing strategy. Done right, paid advertising doesn’t just deliver leads; it equips you with the insights to grow smarter.

Run PPC and Display Ads

PPC and display ads, when executed with the support of a PPC agency, are excellent tools to drive targeted traffic and boost your brand’s visibility. PPC ads allow you to bid on high-intent keywords, such as “wealth management services near me,” to place your business in front of users actively searching for solutions. For example, you could use PPC campaigns to promote a financial planning tool or a free retirement calculator, encouraging prospects to engage with your services.

Display ads, on the other hand, excel at keeping your brand top-of-mind. By retargeting users who have previously visited your website, these ads remind potential clients of what you offer, bringing them back when they’re ready to make a decision. Both PPC and display ads allow you to connect with audiences at different stages of their decision-making process—whether they are researching options or ready to take the next step. This targeted approach ensures better results from your advertising budget.

Use Ad Extensions to Maximize Engagement

Ad extensions are a smart way to make your ads more engaging and useful to potential clients. By adding extra details, you provide more value and increase the chances of someone clicking on your ad. For example, sitelink extensions can highlight specific services like “Investment Planning” or “Loan Calculators,” directing users straight to the information they need. Call extensions are another effective tool—they allow users to contact you directly with a single click, which is especially helpful for time-sensitive inquiries.

These features not only enhance click-through rates but also improve the overall relevance of your ads. They give customers a glimpse of what sets your business apart, making it easier for them to take action. With ad extensions, your ads become a powerful entry point that connects clients to tailored solutions quickly and effectively.

Leverage High Conversion Keywords in Other Channels

High-conversion keywords from your paid advertising campaigns can do more than drive traffic—they can strengthen your entire marketing strategy. By identifying the keywords that generate the most engagement or leads, you gain insights into what your audience truly values. Incorporate these proven keywords into your blog posts, email campaigns, or SEO strategies to amplify their impact. For example, if “best retirement investment tips” performs well in PPC ads, you can create a detailed blog post around that topic or use it as the focus of an email newsletter.

Using high-conversion keywords across channels ensures consistency and helps you reach your audience at multiple touchpoints. It allows you to reinforce successful messaging while improving performance everywhere, from search rankings to email-open rates. This integrated approach maximizes the value of your campaigns, boosting both visibility and conversions across your entire marketing landscape.

7. Use Social Media to Connect with Younger Consumers

Social media has become the go-to space for younger audiences to discover, interact, and share. For financial service companies, it offers a unique opportunity to connect with this tech-savvy demographic on their terms. Platforms like Instagram, TikTok, and even LinkedIn are the perfect spaces to create relatable content that resonates with their interests and life goals. Think short, snappy videos explaining budgeting tips or Instagram reels showcasing easy ways to start investing. These formats make potentially dry financial topics digestible, engaging, and shareable.

But it’s not just about pushing content—it’s about creating conversations. Replying to comments, starting polls, or posing fun financial questions can help build relationships and foster trust. When younger consumers see your company as approachable and authentic, they’re likelier to stick around, engage with your brand further, and view your services as trustworthy. Done well, social media becomes a space not just to grow awareness but to cultivate meaningful, long-term connections.

Leverage Short and Long-Form Videos

Video content is one of the most effective ways to capture the attention of younger consumers. Short-form videos, like those on TikTok or Instagram Reels, allow you to deliver quick, impactful messages. A 15-second clip could offer practical budgeting advice or outline steps to start saving—succinct, engaging, and easy to share. These bite-sized videos meet the fast-paced consumption habits of younger audiences while keeping your brand relevant and top-of-mind.

However, not everyone’s looking for brevity. Long-form videos on platforms like YouTube are perfect for deeper dives into more complex financial topics. An in-depth guide on building credit or planning for retirement can position your brand as a trusted resource. By offering both formats, you appeal to a variety of preferences—quick tips for those on the go and detailed explanations for those looking to learn. This balanced approach not only increases engagement but also broadens your reach, ensuring your message connects across diverse viewing habits.

Host Live Stream Q&A Sessions

Live Q&A sessions offer a powerful way to connect directly with younger consumers. Platforms like Instagram or YouTube make it easy to host these interactive events, where your team can answer pressing questions in real-time. Imagine hosting a live session tackling common concerns about student loans or guiding first-time homebuyers through the mortgage process. These sessions create an open forum for dialogue, where participants feel heard and valued.

Beyond answering questions, live streams make your brand feel approachable and human. By engaging authentically, you build trust and establish your expertise. The immediacy of live interactions fosters a sense of community, turning casual viewers into loyal followers. Plus, these sessions can be recorded and reused as evergreen content, extending their reach and value far beyond the initial broadcast. It’s a modern, personal way to demonstrate your knowledge while forming meaningful connections with a younger audience.

Showcase Expert Opinions and Research

Sharing expert opinions and research on social media can set your brand apart as a trusted authority. Younger consumers, often skeptical of generic advice, are more likely to engage with content backed by credible insights. Posting infographics that break down key findings—like market trends or saving habits—can grab their attention quickly. Pair this with video interviews featuring financial experts who answer real-world questions, and you’ve created content that’s not only informative but also relatable.

This kind of content isn’t just about providing information—it’s about elevating your brand. You educate your audience while demonstrating that your company is at the forefront of the financial industry. Over time, these efforts build credibility and establish your brand as a go-to resource for smart, reliable advice. When younger consumers see you as a thought leader, they’re more likely to trust you for their financial needs now and in the future.

8. Focus on Improving Your Conversion Rates

Maximizing your conversion rates is about turning interest into action. For financial service companies, this means refining your marketing efforts to nudge prospects toward making a decision. Conversion rate optimization (CRO) starts with analyzing how users interact with your website and marketing channels. Are your calls-to-action (CTAs) clear and compelling? Does the user experience guide potential customers smoothly from one step to the next? Small adjustments, like placing CTAs above the fold or simplifying sign-up forms, can make a huge difference in engagement.

Beyond layout tweaks, understanding customer behavior is key. Use analytics tools to uncover where users drop off, then test solutions to fix those pain points. For example, if customers abandon your landing page, it might need shorter text or a more direct offer. CRO doesn’t just boost conversions—it amplifies your ROI by ensuring the traffic you’ve fought hard to attract is more likely to convert. At the same time, it improves the overall user experience, leaving visitors with a positive impression of your brand. It’s not about working harder; it’s about making every step smarter.

Optimize Your Website and Landing Pages

Your website and landing pages are the heart of your digital marketing efforts, so making them conversion-friendly should be a top priority. Start with clear, action-oriented calls-to-action (CTAs) that guide visitors effortlessly. Whether it’s “Get Your Free Quote” or “Schedule a Consultation,” your CTAs should stand out and make the next step obvious. Don’t underestimate the importance of speed either—fast-loading pages keep users engaged. Remember, even a few seconds of delay can cost you valuable leads.

A mobile-friendly design is non-negotiable in today’s world, especially when younger consumers are likely to browse on their phones. Simplified navigation, optimized layouts, and responsive elements ensure that users can find what they need without frustration. These optimizations not only improve the user experience but also increase the chances of convincing prospects to take action. By streamlining their online journey, you make it easier for potential clients to trust your brand and move closer to becoming loyal customers.

Build Trust and Credibility with Social Proof

Social proof is a powerful motivator. When potential clients see evidence of your expertise and reliability, their confidence in your services grows. Testimonials from satisfied customers, positive online reviews, and detailed case studies breathe life into your accomplishments. For example, sharing a customer’s story about how your financial planning services helped them save for their dream home can make an immediate, emotional impact. Similarly, displaying industry certifications or awards prominently on your website reinforces your credibility, proving you’re not just qualified but highly regarded.

This approach speaks directly to doubts or hesitations clients may have. Reviews and success stories show real-world results, creating a sense of reassurance that your services work as promised. People trust what others have experienced, and showcasing this trust builds a stronger connection. Whether it’s through a video testimonial or a simple graphic highlighting your success rate, social proof ensures potential clients see you as dependable, capable, and worth investing in.

Conduct A/B Testing

A/B testing is one of the best ways to fine-tune your marketing strategy. By comparing two variations of a campaign element—like headlines, CTAs, or landing page layouts—you can determine what resonates most with your audience. For instance, imagine testing two different headlines for a retirement savings program. One focuses on the “peace of mind” it offers, while the other emphasizes “maximizing growth.” With A/B testing, you’ll quickly see which approach drives more clicks and conversions, allowing you to pivot confidently.

The insights gained from A/B testing go beyond just one campaign. They reveal what your audience values, how they respond, and what design or messaging creates the best user experience. This data-driven approach helps you avoid guesswork and focus your efforts where they count, resulting in higher conversion rates and better engagement overall. Simply put, A/B testing transforms trial and error into a strategic tool for maximizing results.

9. Ensure Strong UI/UX

A strong user interface (UI) and user experience (UX) are at the core of effective marketing for financial service companies. Why? Because your digital platforms aren’t just tools—they’re often your first touchpoint with potential clients.

Sleek, intuitive designs immediately convey professionalism, while clunky, confusing interfaces can drive users away before you’ve had a chance to show your value. Prioritizing UI/UX means designing systems that are easy to use, engaging, and purposeful. From smooth online account setups to dashboards that make financial tracking feel effortless, a seamless experience keeps users coming back for more.

A solid UI/UX doesn’t just improve satisfaction—it builds trust. When users can easily find answers, complete transactions, or explore their options without glitches, they begin to see your company as reliable and credible. Financial services require a high level of trust, and an intuitive, error-free interface assures clients that their finances are in capable hands.

Beyond trust, a well-designed platform can also increase conversions. For instance, simplifying the steps in a sign-up process or creating a clear path to access your services reduces friction and encourages action. By investing in UI/UX, you’re investing in stronger customer relationships and better results for your marketing efforts.

Provide Intuitive Navigation

Intuitive navigation can make or break a user’s experience on your website. When visitors can effortlessly find what they’re looking for, their satisfaction increases, and they’re more likely to stay longer, explore your services, and ultimately convert. Elements like clear, well-organized menus, logical page hierarchies, and prominent search bars make a world of difference. For instance, a financial service site with straightforward navigation might feature distinct sections for loans, investments, and retirement planning, ensuring users reach the right resources without frustration. By guiding visitors smoothly through your site, you reduce bounce rates and create a positive first impression that leaves them wanting more.

Use High-Quality Visuals

High-quality visuals have a remarkable ability to elevate your brand and simplify even the most complex financial concepts. Professional imagery enhances credibility, making your brand feel polished and trustworthy. Infographics, for instance, can break down dense data—like investment growth comparisons—into eye-catching, digestible designs that viewers can grasp at a glance. Clean and consistent design elements across your website and marketing materials also play a key role in engaging users. Whether it’s a well-crafted banner or sleek chart visuals on a dashboard, presenting information with clarity and visual appeal reinforces your message and leaves a lasting impression.

Prioritize Accessibility

Prioritizing accessibility is more than a thoughtful gesture—it’s a strategic move that broadens your audience and enhances the user experience for everyone. By ensuring your website accommodates all users, including those with disabilities, you make your platform more inclusive and welcoming. Simple steps like adding alt text for images, enabling keyboard-friendly navigation, and using readable font sizes can have a huge impact. Imagine a potential client using a screen reader to explore your financial tools—these adjustments ensure their experience is seamless, building goodwill and trust. Accessibility doesn’t just improve usability; it shows your commitment to inclusivity, which resonates deeply with today’s socially conscious consumers.

Let’s Build Your Financial Brand Together

At Session Interactive, we specialize in fueling growth for financial service companies by delivering tailored digital marketing strategies that deliver measurable results. Whether it’s optimizing your website for conversions, harnessing the power of social media, or crafting data-driven ad campaigns, our team brings the expertise and precision needed to grow your business.

We understand the unique challenges and opportunities in the financial sector, allowing us to create strategies designed specifically for your goals. If you’re ready to elevate your marketing efforts and drive real growth, we’re here to help. Contact us today and take the first step towards transforming your digital presence.