As banking consumers turn more and more to digital platforms, banks need smart digital strategies to stand out. From the power of social media to the precision of pay-per-click advertising and the engagement of content marketing, there are countless opportunities to connect online.

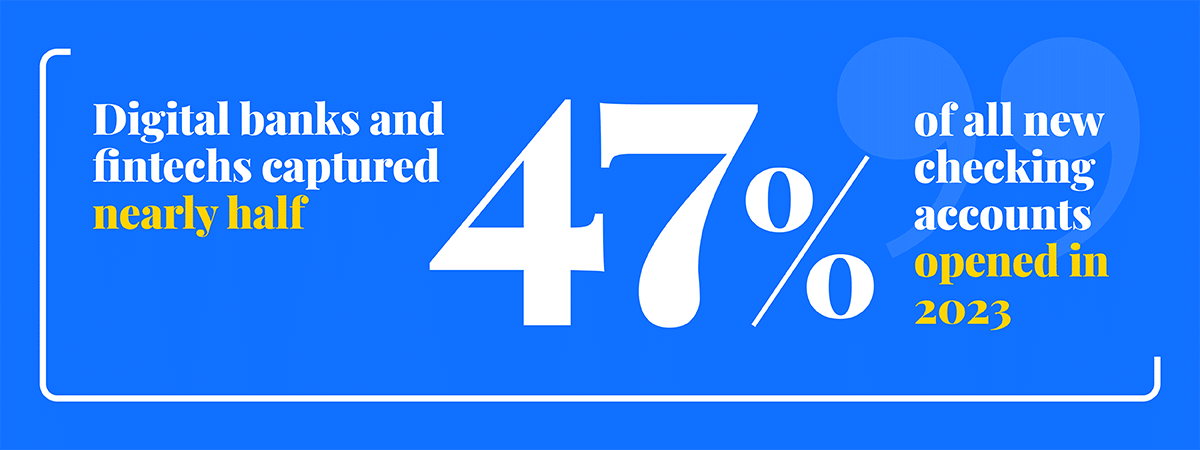

There’s huge opportunity to be seized online. Digital banks and fintechs captured nearly half (47%) of all new checking accounts opened in 2023. Are you ready to join them?

This guide will explore the top digital marketing channels for banks and provide insights into how banks can capitalize on digital trends to attract, engage, and retain customers.

Below, we’ll cover the key components of a comprehensive digital marketing strategy, including tips, tactics, and innovative approaches to bank marketing in the digital realm.

In this guide:

At Session Interactive, we’ve learned the ins and outs of digital marketing for banks from experience. We’ve helped financial institutions like Umpqua Bank and Canvas Credit Union reach and convert customers online.

Banks love our attention to analytical detail. We’re the digital marketing agency for banks that harnesses your data for real results.

Digital Strategy for Banks

A bank’s digital marketing strategy is the roadmap to digital success. It lays out the path for reaching and engaging customers online when they’re most ready to convert.

Banks need to tailor their digital strategies to changing customer needs by integrating seamless online banking experiences, personalized marketing, and targeted campaigns. This includes optimizing websites as sales funnels, using social media for community building, and employing targeted advertising.

What Is a Bank Digital Marketing Strategy?

A bank digital marketing strategy encompasses a comprehensive plan that uses online channels to promote banking products, services, and brand identity. This strategy aims to engage existing customers while attracting new ones.

When approaching their digital marketing strategy, banks should focus on understanding their target audience’s online behavior to tailor content and ads to their specific financial aspirations and interests. Use data to personalize marketing. Banks can, for example, use email marketing campaigns to offer personalized loan options or use social media to educate followers about financial planning.

How to Build a Bank Digital Marketing Plan

Don’t get overwhelmed. Start small and build your strategy brick by brick. A bank digital marketing plan involves outlining clear steps to achieve online engagement and conversion goals. It’s about knowing where you want to go digitally.

Start by conducting a digital audit to understand your current position and then set specific, measurable objectives. Crafting a comprehensive plan requires understanding the competitive landscape, identifying which digital channels your audience uses, and developing compelling content that addresses their customer needs.

Establish Your Goals and KPIs

Start with goals. Setting clear, achievable goals and key performance indicators (KPIs) is crucial for tracking the success of your bank’s digital marketing efforts.

Aim for goals that enhance online visibility, improve customer engagement, and increase conversions. Examples include boosting website traffic, improving the account opening rate online, and enhancing the click-through rate of digital ads. Measure success with KPIs like website analytics, conversion rates, and social media engagement metrics.

Understand Your Ideal Customer Profile (ICP)

Knowing your ideal customer profile lets you create targeted and effective marketing strategies.

Analyze existing customer data to identify common characteristics and behaviors. This includes demographic details, financial needs, and preferred communication channels. Tailoring your messaging and offers to your customer significantly improves engagement and conversion rates.

Leverage Appropriate Channels and Tactics

Choosing the right channels makes sure you’re reaching out to customers where they exist. Otherwise, you’re talking to an empty or irrelevant room.

Consider a mix of digital marketing channels such as social media, email marketing, content marketing, and paid advertising. For instance, using LinkedIn for B2B services and Facebook for consumer banking products. The key is to match the channel with the bank’s target audience preferences and behavior.

Create and Manage a Marketing Calendar

A well-organized marketing calendar ensures consistency, and consistency is key.

Plan your content and campaigns in advance, factoring in seasonal banking needs, holidays, and promotional periods. This allows for a strategic distribution of resources and maximizes the impact of marketing efforts.

Monitor Website Analytics

Keeping a close eye on website analytics provides insights into customer behavior and campaign performance.

Regularly review metrics such as page views, session duration, bounce rate, and conversion paths. This data helps in refining digital strategies, improving user experience, and increasing the effectiveness of marketing campaigns.

The Top Digital Marketing Channels for Banks

As banking goes increasingly online, using a variety of digital marketing channels is key to connecting with customers. From email campaigns to SEO, each channel offers unique opportunities to enhance visibility, engagement, and, ultimately, customer satisfaction.

Email Marketing

Email marketing lets you serve personalized messaging at an impressive scale, ideal for engaging with segmented audiences efficiently.

Local SEO (Search Engine Optimization)

Local SEO optimizes a bank’s online presence to attract more business from relevant local searches. This technique is essential for increasing visibility in specific geographical areas.

Local SEO is a powerful strategy to boost organic search traffic and enhance their authority score, even among the top 20 U.S. banks. Despite varying levels of organic search traffic, all banks can improve their local SEO to target potential customers searching for financial services nearby. Strategies like optimizing for non-branded keywords and creating user-focused content can significantly increase a bank’s visibility and authority, attracting more local customers to their branches or online services.

Email marketing has evolved into a critical tool for maintaining customer relationships and promoting services. Despite the rise of mobile banking and other digital communication methods, financial services emails continue to perform well, boasting above-average open and click-through rates in the U.S. compared to other sectors. Focus on sending relevant content tailored to individual customer needs and avoiding the common pitfall of overloading recipients with too much information at once. That way, each email adds value, creating a good experience (instead of becoming just more spam).

Demand Generation

Demand generation is the holistic approach of creating awareness and demand for a company’s products or services through marketing efforts.

Demand generation extends beyond mere brand recognition—it’s about building trust and educating the market on complex financial products and services. This process involves creating high-quality content that addresses customer needs and pain points, effectively utilizing inbound marketing techniques to nurture leads through the sales funnel. A key challenge for banks is to remain compliant with financial regulations while engaging in these activities. By focusing on providing value and solving problems, banks can foster long-term relationships and drive genuine interest in their offerings.

Content Marketing

Content marketing is the strategic approach of creating and distributing valuable, relevant, and consistent content to attract and retain a targeted audience — ultimately, to drive profitable customer action.

Content marketing becomes a pivotal channel for educating consumers often overwhelmed by financial decisions. By providing clear, accessible educational content, banks can demystify complex financial products and services, fostering trust and loyalty among their customer base. This approach not only helps simplify the decision-making process for consumers but also positions banks as trusted advisors in the financial landscape. It’s an effective way to engage with customers on a deeper level, beyond traditional transactional relationships.

Social Media Marketing

Social media marketing utilizes platforms like Facebook, Twitter, and Instagram to promote a brand, engage with customers, and drive traffic to a website or product page.

Social media marketing offers a unique opportunity to humanize their brand and connect with customers on a personal level. Through engaging content and responsive customer service, banks can foster a community of loyal followers and improve customer satisfaction. However, navigating the regulatory landscape and maintaining customer privacy are significant challenges. To be successful, you need a delicate balance between being informative and engaging while ensuring all communications comply with financial regulations.

Pay-Per-Click (PPC)

Pay-Per-Click (PPC) is a method of online advertising where advertisers pay a fee each time one of their ads is clicked. It’s a direct route to increasing website traffic and targeting specific audiences.

PPC can be an effective channel for promoting financial products like loans, credit cards, and savings accounts, thanks to its ability to target ads based on user search queries and interests. The sector benefits from an average return on investment (ROI) of 200%, highlighting the efficiency of PPC in driving valuable actions. However, banks face challenges such as navigating industry-specific regulations and high competition for keywords. Incorporating local search strategies is crucial, as 46% of Google searches are for local information, and with mobile devices accounting for 70% of search ad impressions, optimizing campaigns for mobile users is also essential.

Podcast Advertising

Podcast advertising refers to the placement of ads within audio podcasts, allowing brands to reach engaged audiences in a highly intimate and targeted way.

Podcast advertising presents an innovative avenue to build brand awareness and establish thought leadership within the financial industry. By sponsoring podcasts related to finance, investment, or personal money management, banks can connect with audiences interested in financial literacy in a context that feels natural and engaging. One of the main benefits includes the ability to target niche markets with precision, tapping into dedicated listeners who value expert insights. However, measuring the direct impact on ROI can be challenging, as podcast advertising often contributes to brand lift rather than immediate conversions.

11 Bank Marketing Strategies and Insights

In today’s competitive banking landscape, innovative marketing strategies and insightful tactics are essential for attracting and retaining customers. From leveraging digital technologies to enhancing customer experience, banks must explore varied channels and methodologies to stay ahead. Here’s a comprehensive guide to effective bank marketing strategies and insights.

1. Ad Retargeting

Ad retargeting allows banks to re-engage visitors who have shown interest in their products but have not completed an action. Banks can increase conversion rates and reinforce brand recall by displaying relevant ads to these potential customers as they browse other sites.

2. Influencer Marketing Partnerships

Banks can significantly boost their brand’s trust and visibility by partnering with influencers who resonate with their target audience. These partnerships can humanize the bank’s brand and convey complex financial concepts in a relatable manner, driving engagement and new account sign-ups.

3. Multichannel Campaigns

Integrating digital and non-digital marketing efforts can amplify a bank’s reach and message. For example, direct mail campaigns offering a special rate for online savings accounts can encourage customers to engage with online banking platforms, creating a seamless customer experience across channels.

4. Financial Management Tools

Offering financial management tools such as loan calculators, savings goal calculators, or budgeting apps can attract potential customers by providing them with valuable resources. These tools not only assist in financial planning but also position the bank as a helpful advisor in the customer’s financial journey.

5. Video Marketing

Banks can leverage video marketing to demonstrate complex financial products, share customer testimonials, or provide mini-tutorials on using online banking services. Videos can make banking more approachable and digestible, improving customer understanding and engagement.

6. Retention Marketing

Banks can enhance customer satisfaction and loyalty by focusing on nurturing existing customer relationships through personalized offers, exclusive services, or loyalty rewards. Diversifying services based on customer needs ensures long-term engagement and retention.

7. Financial Education Content

Creating and distributing content that educates customers about financial well-being, investment strategies, or the benefits of different banking products can solidify a bank’s role as a trusted advisor. This strategy aligns closely with the bank’s product offerings and customer needs.

8. Focus on Online Banking

Incorporating a strong online banking strategy is increasingly critical, as digital banking services have been used by most Americans in the past year, highlighting a significant shift away from traditional banking. With over 2,500 bank branches closing in 2023 and mobile banking being the primary method of account access for 48% of Americans, banks must prioritize their digital platforms to meet customer expectations for convenience, efficiency, and enhanced services. Tailoring services to be more accessible online can help banks stay competitive in this digital-first era.

9. Product and Service Content

Making detailed and user-friendly information readily available for all core banking products and services simplifies the decision-making process for potential members. Clear, accessible content helps demystify banking services, making them more approachable to a broader audience.

10. Resources and FAQs

Equipping existing members with extensive resources and a comprehensive FAQ section can significantly enhance the banking experience. This approach addresses common queries and concerns promptly, reducing support calls and increasing customer satisfaction.

11. Digital Loyalty Programs

Implementing digital loyalty programs that reward customers for their banking activities can foster stronger relationships and encourage continued engagement. Tailored rewards, whether for saving, spending, or referring new customers, can significantly enhance customer loyalty and advocacy.

Putting Ideas into Action

We hope that this guide has taught you the importance of a tailored approach to reaching and converting potential clients online. Whether it’s through targeted ad campaigns, engaging content, or innovative use of technology, the goal is clear: to connect with your audience effectively and secure their trust in your financial services.

As with most things in life, this is easier said than done. You need great research skills, a deep understanding of digital advertising systems, and the ability to adapt to changing search landscapes. Session Interactive has all of these and more. We’ll show you why banks are turning to Session Interactive for bespoke digital marketing solutions.

Unlock Your Bank’s Digital Marketing Potential

Ready to start driving real results today? Request a consultation with Session. Our experts are here to help you craft a personalized, data-driven approach that captivates and converts.