In an increasingly digital world, advertising for credit unions has taken a significant leap forward.

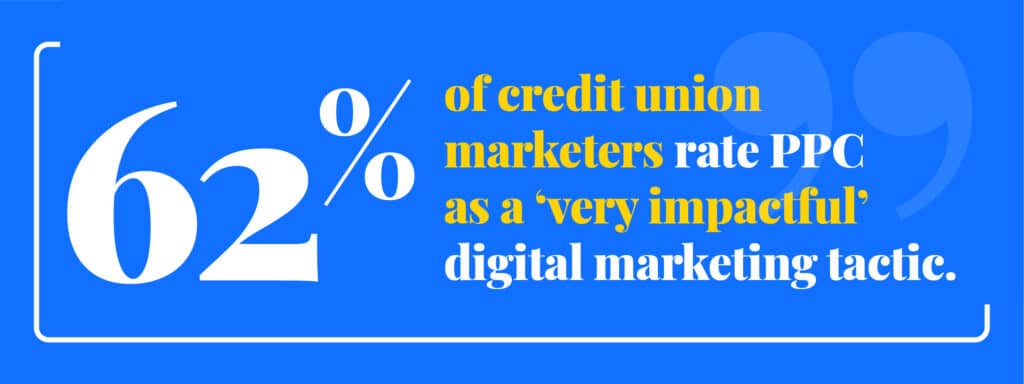

A 2022 survey of credit union marketers reveals that pay-per-click (PPC) is the second most effective marketing tactic, right after email marketing.

In the same survey, 62% of credit union marketers rated PPC as a “very impactful” digital marketing tactic. That’s higher than tactics like content marketing, marketing automation, and even SEO.

These responses highlight the growing importance of digital advertising in credit union marketing.

This guide will provide a comprehensive look at digital advertising for credit unions, highlighting proven tactics, emerging trends, and best practices to help your credit union thrive.

In this guide:

At Session Interactive, we worked closely with banks and credit unions to achieve their digital marketing goals. Our paid search, paid social, and display advertising teams have years of experience generating leads for institutions like Canvas Credit Union and Community Financial Credit Union.

As a leading PPC agency for credit unions, we have firsthand experience with strategies and tactics that help non-profit financial institutions grow online.

Credit Union Advertising 101

Credit union advertising is a strategic way to enhance brand visibility, engage audiences, and drive website traffic. It’s imperative that credit unions use results-oriented advertising strategies to stay ahead of their increasingly savvy competitors. A well-planned approach enhances visibility and fosters trust and engagement among existing and potential members.

What Are the Primary Types of Credit Union Ads?

Credit unions use a variety of advertising methods, including digital ads, TV commercials, and affiliate marketing. The three primary types of digital advertising that have proven effective for credit unions are Pay-Per-Click (PPC), display advertising, and social media advertising. Here’s how they work:

PPC for Credit Unions

Pay-Per-Click (PPC) advertising is a tactical approach in digital marketing that involves advertisers paying each time their ad is clicked. It’s an effective tool for driving targeted traffic to your website, enhancing online visibility and member engagement.

For example, credit unions could bid on keywords related to their services like “local credit union” or “high-interest savings.” Using geo-targeting, they can reach local individuals actively searching for these services in their area. This strategic application of PPC advertising can help credit unions acquire new members and promote specific financial products or services effectively.

Display Advertising for Credit Unions

Display advertising is a form of online marketing that uses visual content, like banners, to promote services. It’s a strategic way to enhance brand visibility, engage audiences, and drive traffic to their website.

For instance, credit unions can create display ads showcasing their competitive rates or member benefits on financial websites or local news sites. By using retargeting strategies, they can also re-engage visitors who have previously visited their website, reinforcing the credit union’s value proposition and encouraging them to become members.

Top tip: consider aspirational content focused on what the members can do with their money rather than the money itself. Aspirational content does well and is currently underserved by credit unions, according to a 2023 report.

Social Media Ads for Credit Unions

Social media advertising is a powerful tool that involves promoting services on platforms where potential members spend their time.

Examples of social media advertising strategies include creating targeted Facebook ads highlighting the benefits of membership or sharing client testimonials on LinkedIn to demonstrate reliability and trust. Regularly posting engaging content about financial literacy on Instagram can also help build a loyal following and attract younger demographics to credit unions.

The Benefits of Paid Ads for Credit Unions

For credit unions, paid advertising is an effective way to get immediate visibility and increase brand awareness. Paid ads allow credit unions to target specific audiences based on demographics and geographic locations, foster community engagement, and attract new members.

Paid advertising also allows credit unions to track click data and identify their highest converting keywords. These keywords can then be used to convert users across other channels such as SEO and content marketing.

Top Advertising Networks for Credit Unions

Choosing the right advertising network is crucial for credit unions aiming to maximize their online presence. These platforms can provide access to a wide audience, sophisticated targeting capabilities, and in-depth analytics to measure campaign success. Here, we introduce some of the top advertising networks that credit unions can leverage to reach potential members and amplify their message.

Google Ads

Google Ads offers credit unions a variety of advertising options to boost their online presence. These include search ads that appear at the top of Google search results, display ads on the Google Display Network reaching over 90% of internet users worldwide, and local search ads that target specific geographic areas.

Credit unions can leverage Google Ads by bidding on keywords related to banking and their own branding. For example, they could run search ads for “low-rate credit cards” or “local credit union,” ensuring their services appear prominently when potential members search these terms. Display ads can be used to retarget visitors, keeping the credit union at the forefront of their minds. Local search ads can help attract members in the surrounding community, promoting the credit union’s commitment to local service.

Meta Ads (Facebook and Instagram)

Meta Ads, encompassing both Facebook Ads and Instagram Ads, present a robust set of advertising options for credit unions. These platforms offer various ad formats, including image, video, and carousel ads, that can be displayed in feeds, stories, or even as in-stream videos.

Credit unions can use Meta Ads to create highly targeted campaigns based on demographics, interests, and behaviors. For example, they can use Facebook’s detailed targeting to reach individuals interested in home ownership, promoting their mortgage products. Instagram, with its visually rich platform, is ideal for showcasing community involvement or sharing customer success stories. The carousel ad format could be used to highlight the multiple benefits of becoming a union member, each slide emphasizing a unique value proposition.

Microsoft Advertising

Microsoft Advertising, formerly known as Bing Ads, offers credit unions a platform to reach an audience that may not be covered by Google Ads. It provides options such as search ads in Bing, Yahoo, and other partner sites, and display ads which appear on Microsoft-owned websites and apps. These platforms enable credit unions to connect with potential members who are actively searching for their services or are likely to be interested based on their online behavior.

LinkedIn Ads

LinkedIn, as a professional networking platform, presents credit unions with unique advertising opportunities. It offers Sponsored Content, Message Ads, Dynamic Ads, and Text Ads, all tailored to reach a professional audience. This platform can be particularly effective for B2B campaigns, helping credit unions establish partnerships, promote business banking services, or recruit top talent in the financial sector. The precise targeting options on LinkedIn, based on industry, job function, and seniority, allow credit unions to communicate their value proposition directly to decision-makers.

Other Channels

Beyond the popular platforms, credit unions have a variety of other advertising channels at their disposal. Alternative display ad networks like Taboola or Outbrain can help reach audiences through content recommendation on news sites and blogs. Social media networks such as Twitter, Pinterest, and Snapchat also offer advertising options tailored to their unique user base. These platforms provide demographic targeting and interest-based segmentation, allowing credit unions to craft campaigns that resonate with specific audience groups.

Credit Union Advertising Tips and Ideas

Credit unions must stay ahead of the curve with innovative and strategic advertising approaches if they want to succeed. Whether you’re aiming to attract new members, promote your unique products, or simply raise brand awareness, these tips are designed to guide you towards success.

1. Create Cross-Channel Campaigns

For credit unions, cross-channel campaigns can be a powerful way to reach potential members at different stages of their financial journey. For instance, you might promote your competitive mortgage rates through display ads on relevant blogs and news sites, while using social media to highlight success stories from satisfied homeowners who benefited from your services. These ad campaigns can integrate with other parts of your credit union’s overall digital strategy. When combined with credit union SEO or social media campaigns, digital advertising can create a full-funnel approach that drives awareness, engagement, and ultimately, conversions.

2. Convert Potential Members With Retargeting Campaigns

Retargeting campaigns are a powerful tool for credit unions to convert potential members who have visited their web properties but haven’t yet taken the next step. For instance, if a visitor browses your auto loan page but doesn’t apply, you can retarget them with ads highlighting the benefits of your auto loan services. This keeps your credit union top of mind and provides an encouraging nudge towards conversion. According to research by The Financial Brand, retargeting is highly effective based on reach, cost, and performance, making it a valuable part of your digital strategy.

3. Target Competitor Search Terms

Pay-per-click (PPC) advertising offers an effective way for credit unions to target competitor search terms. For instance, you could bid on terms like “bank near me” or competitor names, which your potential members might be using. Although these terms can be challenging to rank for through SEO strategies alone, PPC ads can help your credit union appear prominently in search results. This strategy can attract users who are looking for financial services and may not have considered a credit union as a viable alternative to traditional banks.

4. Place Display Ads in Financial Content

Display ads, placed strategically within relevant financial content, can effectively reach your target audience. For instance, a credit union could place an ad about their competitive loan rates in an article about personal finance management or mortgage refinancing. Advertising on well-established financial news websites is an effective way to reach an engaged audience. This approach ensures that your message is seen by individuals actively seeking financial information and solutions, thereby increasing the chances of driving member conversions.

5. Optimize Campaigns With Analytics and Testing

To ensure the highest ROI for your credit union’s marketing efforts, it’s essential to leverage analytics and conduct A/B testing. Analytics provides insightful data about campaign performance, helping identify successful strategies and areas for improvement. For instance, if one loan promotion is outperforming another, you can analyze why and apply those learnings to future campaigns. A/B testing allows you to compare two versions of an ad or landing page to determine which one resonates more with your audience, leading to more effective, results-oriented campaigns.

Harness the Power of Strategic Digital Marketing

A strategic, results-oriented approach to marketing is paramount for credit unions aiming to grow their membership. By targeting competitor search terms, placing display ads in financial content, and optimizing campaigns with analytics and testing, you can effectively reach potential members and drive conversions.

At Session Interactive, we specialize in creating powerful, data-driven digital marketing strategies that deliver results. Our expertise in the credit union sector, coupled with our commitment to clear communication and trust, makes us the perfect partner for your digital marketing needs.

Ready to take your credit union’s digital marketing to the next level? Contact Session Interactive today and let us help you harness the power of strategic digital marketing.