Marketing isn’t just about selling products—it’s about creating connections. This is especially true for credit unions. Unlike traditional banks, credit unions emphasize community, trust, and member relationships. This focus makes content marketing essential. A well-executed content marketing strategy gives credit unions the tools to engage members, educate audiences, and grow their reach. Yet, many credit unions struggle to stand out in an increasingly crowded digital landscape.

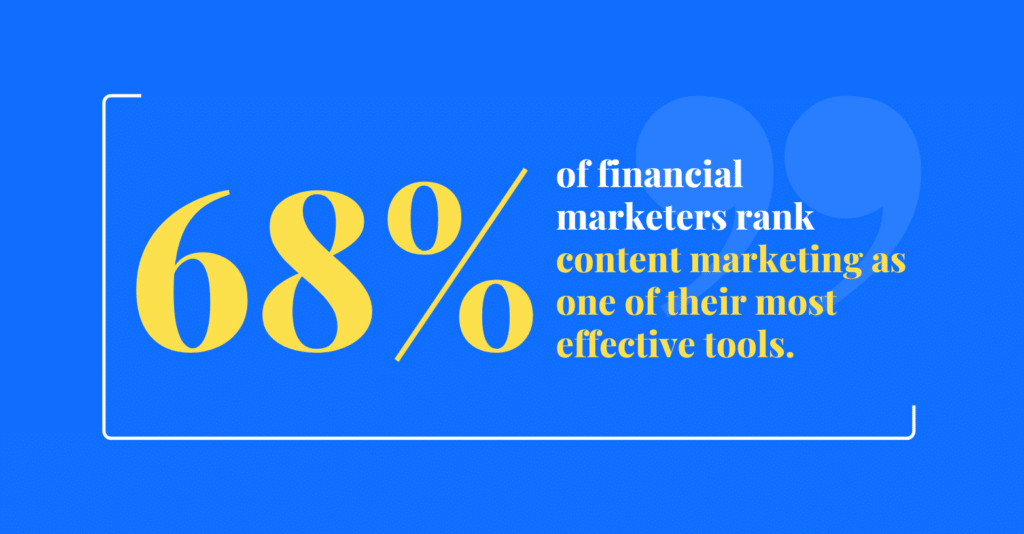

Consider this: 68% of financial marketers rank content marketing as one of their most effective tools. Credit unions have a remarkable opportunity to meet these expectations by offering tailored content. However, their challenges are unique. Credit unions must balance driving membership growth with deepening trust and remaining true to their values of financial education and community impact.

At Session Interactive, we understand the unique marketing dynamics of credit unions. As a seasoned digital marketing agency for credit unions, we have a strong track record of driving measurable marketing success in the financial services space. We work alongside credit unions to craft content strategies that build member loyalty and reach new audiences. With a decade of experience navigating the intersection of finance and marketing, we know the hurdles credit unions face, and we turn those challenges into impactful opportunities.

The Benefits of Content Marketing for Credit Unions

Content marketing offers credit unions an unparalleled opportunity to deepen their connection with members while attracting new audiences. By creating and sharing valuable, relevant content, credit unions can reinforce their community-focused values, educate members, and stand out in a competitive financial services market. With the right approach to scaling content systems, each piece of well-crafted content serves a purpose—from building trust to driving business growth—making content marketing a vital component of a credit union’s strategy.

Builds Trust and Credibility

Trust is the foundation of any successful credit union. Credit unions can showcase their expertise and reliability by consistently offering content that addresses member concerns, answers financial questions, and delivers insightful advice. Content like financial tips, success stories, or expert Q&A sessions demonstrates transparency and care, which are key to earning and maintaining member trust.

Educates and Engages Your Audience

Credit unions have a unique opportunity to educate their communities. Content marketing enables them to share information that helps members make informed financial decisions. Blogs on topics like budgeting or saving for retirement foster engagement and provide value. Building content informs members while keeping them connected to your brand.

Attracts New Members

A strong content marketing strategy highlights what sets credit unions apart: personalized service, community values, and a member-first approach. Targeted campaigns that tell these stories can draw in individuals seeking an alternative to traditional banks. For example, sharing member testimonials or highlighting community initiatives on social platforms can inspire trust and spark interest in potential members.

Supports Member Retention

Retaining members requires more than offering financial products; it’s about staying relevant in their lives. Consistent, meaningful content keeps your credit union at the forefront of your mind and builds long-term loyalty. Consider monthly newsletters with personalized advice to exclusive educational resources to ensure members feel valued and supported throughout their financial journeys.

Drives Business Growth

Content marketing drives measurable results. With the right strategy, content can expand your audience reach, boost website traffic, and generate leads. Engaged members are more likely to take action, whether it’s opening new accounts or referring others. By tying content marketing efforts to business goals, credit unions can create a powerful growth engine that benefits members and the institution.

10 Credit Union Content Marketing Strategies and Tactics

Well-structured content marketing is essential for growing credit unions. Let’s explore how to use targeted strategies to communicate values, build trust, and address real member needs. These actionable tactics simplify planning, boost engagement, and deliver measurable outcomes. Let’s dive in!

1. Identify Your Ideal Customer Profile (ICP)

Identifying your Ideal Customer Profile (ICP) is the first step to crafting compelling content marketing. Understanding who your ideal members are allows you to create content that speaks directly to their needs, preferences, and values. This, in turn, enhances engagement and attracts the right audience.

- Conduct Market Research: Market research provides vital insights into the audience you want to reach. Credit unions can use tools like surveys, focus groups, or community forums to learn more about their potential members. For example, surveying to understand what financial services residents value most can highlight priorities such as low-interest loans for small businesses or better online banking tools. By collecting and analyzing this data, you can align your content with the specific needs of your audience, ensuring relevance and resonance.

- Analyze Existing Customer Data: Your current members hold a wealth of information that can guide your content strategy. Analyzing data such as age demographics or service usage patterns can uncover trends that point to what members genuinely value. For instance, if younger members frequently use mobile banking features, you might create content highlighting tech-driven benefits. Using what you already know about your members helps focus your content and ensures it adds value to their financial lives.

- Evaluate Customer Pain Points: Understanding your members’ challenges is crucial to creating meaningful content. Use tools like member feedback forms or call center queries to identify common concerns, such as a lack of financial literacy or struggles with retirement savings. Creating content that addresses these pain points—like blog posts on budgeting tips or guides to investment basics—positions your credit union as a trusted resource while actively helping your audience solve their problems.

2. Determine Your Goals and KPIs

Setting clear goals and KPIs is crucial to any successful content marketing strategy. You need a roadmap to measure results and keep your efforts focused on what matters most. Clear benchmarks help you see what’s working, identify improvement areas, and stay aligned with the bigger picture. Here’s how to shape your goals and track progress.

- Map Performance Goals: Define what success looks like before creating content. Do you want to drive more traffic to your website? Or are you looking to boost loan applications? Setting performance goals gives you a clear direction. For example, you might aim to increase website visits by 20% in six months by publishing educational blogs or promoting online banking services. When you know exactly what you’re working towards, planning and acting is easier.

- Identify Key Metrics: To measure progress effectively, you need metrics that match your goals. For example, if you want to grow email subscribers, track numbers like sign-up or email open rates. To boost engagement, focus on metrics like social media shares or click-through rates. By identifying the right metrics, you can monitor how your content performs and make well-timed adjustments.

- Align with Business Objects: Your content strategy should always support the credit union’s overall goals. Consider how your efforts help improve member retention or grow deposits. For example, content that highlights the benefits of loyalty programs is directly related to retention. Aligning content with big-picture objectives ensures that your strategy delivers value beyond marketing outcomes.

3. Outline Your Overall Content Strategy

Outlining a content strategy helps you stay organized and ensures your efforts deliver real value to your members. Creating a clear plan allows you to develop content that meets member needs, solves challenges, and supports your credit union’s goals. A well-thought-out strategy also keeps your team aligned and focused on delivering results. Here are key steps to build your plan effectively.

- Determine Pain Point Solutions: Focus on solving your members’ challenges. Review questions from member interactions or feedback surveys to pinpoint their pain points. Then, create content that offers practical solutions. For instance, if members struggle with budgeting, design an easy-to-use budgeting guide or host a webinar on personal finance basics. If you’re confused about loan options, publish a comparison tool showing the differences between mortgage products. This approach ensures your content is helpful and relevant.

- Map Content to the Customer Journey: Tailor your content to match where your members are in their decision-making process. For those in the awareness stage, focus on educational content like “What is a Credit Union?” articles or videos. During the consideration stage, highlight benefits through case studies or testimonials. At the decision stage, provide detailed product guides or sign-up instructions. Aligning content with the customer journey makes it easier for members to engage with the right message at the right time.

- Decide on Content Types: Different formats resonate with different audiences, so choose wisely. Younger members prefer bite-sized content like social media posts or short videos, while older audiences may favor detailed blogs or downloadable eBooks. For example, an infographic breaking down the steps to open an account appeals to visual learners, while a video story about a member’s small business loan can inspire others. Pick formats based on your audience’s preferences to maximize engagement.

4. Focus on Your Marketing Channels

Focusing on the proper marketing channels ensures you reach your audience effectively and maximize your resources. Not all channels will work for every credit union, so it’s essential to pick the ones that align with your members’ preferences and behaviors. A strategic approach helps you connect with members where they spend their time, delivering impactful and well-timed messaging. Here’s how to refine your channel focus.

- Prioritize Owned Channels: Your most reliable assets are owned channels like your website, email, and social media. They give you complete control over content, tone, and timing. Optimize your website by keeping it user-friendly and using resources like financial calculators or FAQs. Use email to share tailored content such as loan offers or holiday savings tips. Engage with members through polls, updates, or success stories on social media. Focusing on these channels builds trust and keeps communication consistent.

- Analyze Your Competitors: Understanding how competitors use their channels can give you an edge. Look at their online presence to spot gaps in their messaging or services. For example, if they aren’t focusing on financial education, create blog posts or videos addressing budgeting and credit management. Alternatively, if a competitor excels in a particular area, like social media engagement, study their approach and adapt it to your strategy. You can refine your efforts by analyzing what they do well—or miss entirely.

- Test and Measure Pilot Campaigns: Starting small helps you identify the most effective channels without overspending. Run pilot campaigns to test which platforms or messages work best, refining your PPC strategy to ensure optimal performance and ROI. For instance, A/B test email subject lines to see which version gets more open. Experiment with different ad formats or post types on social media, such as carousels versus single images. Use the data from these small-scale efforts to refine and expand successful approaches, ensuring your budget delivers results.

5. Create a Content Distribution Plan

A solid content distribution plan ensures your efforts don’t go unnoticed. It helps you reach the right audience at the right time, maximizing the impact of everything you create. Without a plan, even the best content can fall flat. By organizing how and where you share materials, you can amplify and increase the value of your work. Here are some practical ways to distribute content effectively.

- Repurpose Existing Content: Repurposing saves time and extends the life of your content. Take a long blog post about budgeting and turn it into a short video for social media or an infographic for emails. You can also pull key points from a webinar and create a quick tips sheet. For example, if you’ve held a Q&A session on mortgages, use the questions to create an FAQ section on your site. Repurposing lets you reach members in multiple ways while keeping your content fresh.

- Establish Syndication Partnerships: Partnering with like-minded organizations or platforms can help widen your reach. For instance, you might collaborate with local financial literacy nonprofits to share your content. Guest blogging on trusted websites or newsletters is another effective way to showcase your expertise. A local community group could share your educational posts about savings programs, introducing your credit union to a broader audience. These partnerships strengthen your presence while building trust in your brand.

- Use Distribution Tools: Distribution tools simplify how you share content and keep everything organized. Use social media schedulers to pre-plan posts and ensure consistency across platforms. Email marketing tools can help you send newsletters with personalized recommendations to different member segments. For example, a tool like Mailchimp can track open rates and clicks, letting you optimize future communications. These tools save time and ensure your content gets in front of the right people efficiently.

6. Conduct Keyword and Topical Research

Keyword and topical research, guided by an experienced SEO agency and a well-defined SEO strategy, are essential for creating content that resonates with your members and ranks well in search results. They help you understand what your audience is searching for and how you can meet their needs. For credit unions, this means focusing on terms and topics that align with financial services and member education. You can boost visibility and provide real value by targeting the right keywords and organizing them strategically.

- Segment Keywords & Topics by Intent: Group your keywords by user intent to create targeted content, ensuring alignment with a broader SEO strategy to maximize visibility and engagement. Intent categories like informational, navigational, and transactional guide how you approach each topic. For example, “how to save for retirement” signals an informational intent and could lead to an educational blog or video. “Best credit union near me” has a navigational intent, suggesting the need for a location-based member webpage. For transactional terms like “apply for a car loan,” craft pages with clear instructions and CTAs. This segmentation ensures your content aligns with what members are looking for.

- Leverage Niche Industry Expertise: Your credit union’s unique expertise is a tremendous resource for creating specialized content. Tap into local insights or community-focused lending knowledge to stand out. For instance, if your credit union offers agricultural loans, write detailed guides on how farmers can access funding. You can also create content around financial programs unique to your area, like first-time homebuyer initiatives. Tailoring content to what you know best builds authority and deepens trust with your members.

- Optimize for Financial-Specific SERP Features: Search engine results pages (SERPs) often include features like snippets, FAQs, and calculators tailored to financial queries. Optimize your content to appear in these spaces. Create FAQ pages that answer common member questions like “What is a credit union?” or “How does a mortgage refinance work?”. Embed interactive tools, such as loan or savings calculators, on your site to provide immediate, practical value. By optimizing for these features, you can capture attention and deliver exactly what your audience needs.

7. Develop an Easy to Manage Content Calendar

A content calendar is key to keeping your marketing efforts organized and consistent. It helps you plan ahead, avoid last-minute scrambles, and ensure your content stays aligned with your goals. For credit unions, it’s about delivering valuable information to members on time and across the right channels. By creating a calendar that’s simple to follow, you can streamline your workflow and focus on what matters most—engaging your members. Here’s how to build one that works for you.

- Plan Content by Themes and Categories: Start by organizing your content around clear themes or categories. This makes planning easier and ensures your messaging feels cohesive. For example, you could focus on financial literacy in April, with blogs and videos tied to National Credit Union Youth Month. Or develop seasonal campaigns, like holiday budgeting tips or end-of-year tax planning guides. Grouping content under specific themes helps you maintain variety while staying relevant to member needs.

- Assign Roles and Responsibilities: Clear delegation is key to keeping your content calendar on track. Assign tasks like writing, editing, or publishing to team members based on their strengths. For instance, one person might draft blog posts while another handles social media visuals. Coordinating the calendar ensures deadlines aren’t missed. Making roles explicit avoids confusion and promotes collaboration, keeping everyone aligned toward shared goals.

- Establish a Production Cadence: A steady and realistic schedule makes content creation manageable. Determine how often you’ll publish based on your team’s capacity and member preferences. For example, you might commit to a weekly blog post, a bi-weekly podcast episode, or a monthly email newsletter. Sticking to a cadence creates consistency, which builds trust with your audience. Use your calendar to track key dates, like campaign launches, and stay ahead of your deadlines without feeling overwhelmed.

8. Set Up Tracking and Analytics

Tracking and analytics are critical for understanding how your content performs and ensuring your SEO strategy and PPC strategy yield tangible results. You can refine your approach and allocate resources more effectively by measuring what’s working and what’s not. Tracking engagement and member interactions for credit unions can reveal valuable insights into member preferences and pain points. Here’s how to set up systems that help you stay on top of your performance.

- Implement Tracking Tools: Start with tools that capture essential data about your content’s performance. Platforms like Google Analytics can show website traffic trends, such as which blog posts drive the most visits. Social media insights, such as engagement rates or shares, reveal what resonates with your followers. For instance, you might find that posts with quick savings tips perform better than promotional messages. Use these tools to monitor audience behaviors and adjust your content strategy accordingly.

- Create Attribution Models: Understanding how members interact with your content across multiple touchpoints is key. Attribution models help you assign credit to specific channels or campaigns, showing you what’s driving results. For example, a first-click attribution model might reveal which search terms brought visitors to your website, while a multi-touch model could highlight how members engaged with your email before filling out a loan application. This clarity helps you prioritize the most impactful efforts.

- Build Monitoring Dashboards: Consolidate your key metrics into user-friendly dashboards for real-time tracking and reporting. Dashboards can highlight everything from loan application conversions to email open rates or social media engagement. For example, tracking data on members exploring a mortgage calculator versus those who complete a pre-approval application can guide targeted follow-ups. Dashboards keep your team aligned and provide visual insights to measure success and support decision-making.

9. Write and Publish Content

Writing and publishing high-quality content is a powerful way to connect with your credit union’s members. It builds trust, delivers value, and showcases your expertise in financial services. Consistently sharing content that addresses member questions or challenges helps you establish a reliable presence in their financial journeys. Here’s how you can approach content creation to maximize its impact.

- Use SMEs and Focus On Value: Collaborating with subject matter experts (SMEs) ensures your content is both accurate and insightful. SMEs can provide real-world expertise that resonates with members. For instance, you could interview a loan officer to create a blog post on common mortgage application mistakes or feature a financial advisor’s tips for budgeting on a webinar. You ensure your content offers tangible value by focusing on actionable advice and addressing member concerns.

- Leverage Custom Visuals: Visuals can make your content more engaging and easier to understand. Tools like infographics, charts, or branded images help bring complex financial topics to life. For example, you can design a chart to show how different loan interest rates affect monthly payments or use an infographic to outline the steps for securing a home loan. Custom visuals enhance your content’s appeal while reinforcing your credit union’s branding.

- Maintain a Consistent Tone and Voice: Consistent tone and voice build a cohesive brand identity that members can trust. Your content should reflect your credit union’s friendly, clear, and approachable personality. For example, when crafting email newsletters or blog posts, avoid overly technical jargon and explain financial concepts straightforwardly. Remaining genuine and professional in your communication ensures members feel comfortable connecting with your credit union.

10. Monitor and Improve Performance

Monitoring and improving content performance ensures your strategies remain effective and aligned with member needs. Credit unions benefit from staying proactive—reviewing what’s working, tweaking what’s not, and continually delivering value. Keeping a close eye on performance data allows you to refine your approach over time, ensuring that your content stays relevant and achieves measurable results. Here are key tactics to help you stay ahead.

- Review Performance Data: Regularly analyzing performance data gives you insights into what’s resonating with your audience. Look at metrics like website traffic, time spent on pages, or conversion rates to spot patterns and opportunities. For instance, you might discover that a blog about car loans leads to the highest number of loan applications. You can develop similar content or expand that topic with related posts or resources with this insight. Metrics help you focus on tactics that deliver results.

- Conduct A/B Testing: A/B testing allows you to optimize content by experimenting with small changes. Test different variations of elements like email subject lines, blog headlines, or call-to-action buttons to see what works best. For example, you could compare two email subject lines—one promoting “Tips for Saving” versus another offering “Five Quick Ways to Budget Better.” If one drives significantly higher open rates, you’ve gained valuable data to refine your messaging and improve engagement.

- Establish a Content Refresh Schedule: Content doesn’t stay fresh forever. Establish a schedule to update older pieces, keeping them accurate and relevant. For example, refresh a blog on retirement saving by adding recent statistics or revising outdated financial strategies. Regular updates also signal to search engines that your content is current, potentially boosting rankings. Revisited content saves you time and ensures you consistently provide value without starting from scratch.

Fuel Growth with Session Interactive’s Tailored Marketing Solutions

Session Interactive brings unmatched expertise to help credit unions achieve their content marketing goals and drive meaningful growth. We specialize in digital marketing strategies for financial institutions. We get the complications of educating the public about these complex financial products. We’ll ensure your content resonates with members and aligns with your mission.

From increasing member engagement to crafting campaigns that deliver measurable results, our team works as your partner every step of the way. Our deep understanding of credit union challenges and opportunities allows us to provide the clarity and collaboration you need to grow your credit union.