The financial services industry is built on trust, expertise, and the ability to connect with clients at crucial moments. But in today’s competitive digital landscape, how do you ensure your business stands out?

We strongly recommend investing in Search Engine Optimization (SEO). Partnering with an SEO agency for financial services can help providers—from wealth management firms to mortgage lenders—position themselves as trusted experts in the competitive digital landscape.

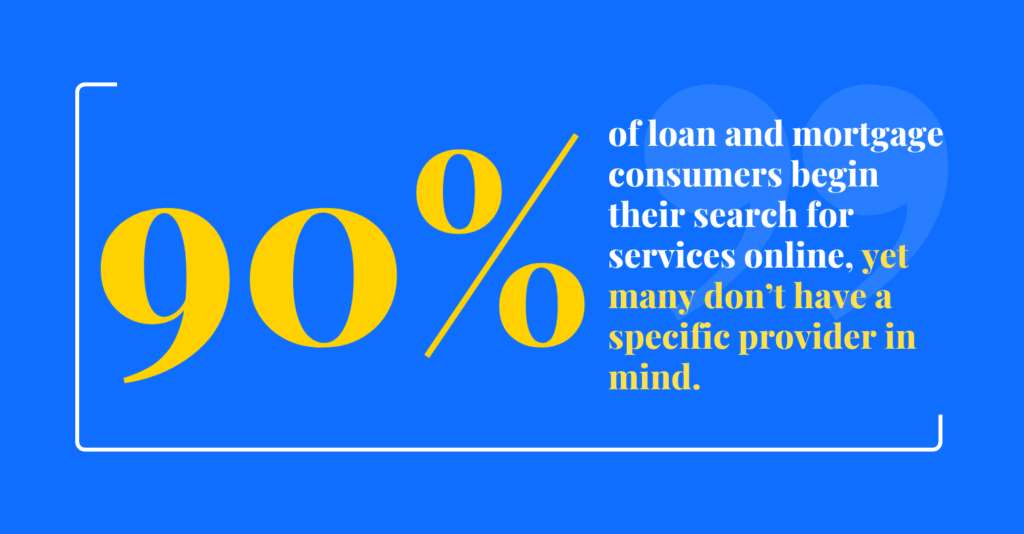

Consider this: 90% of loan and mortgage consumers begin their search for services online, yet many don’t have a specific provider in mind. Even more, 64% of calls to financial services providers—often the most valuable leads—come directly from organic search. SEO doesn’t just help you get found; it positions your business as a credible, trusted solution at the exact moment potential clients are searching for answers.

However, SEO in the financial sector comes with unique challenges. With strict regulations, high competition, and the need for absolute accuracy in messaging, every move matters. That’s where this guide comes in. We’ll break down actionable strategies tailored to help financial organizations like yours increase visibility, bolster credibility, and grow client acquisition.

From mastering high-intent keywords to optimizing local search and crafting expert content, we’ll show you how to leverage SEO to meet your goals. Success online starts with being seen in the right place at the right time—ready to take that step? Let’s begin.

In this guide:

At Session Interactive, a trusted digital marketing agency for financial services, we understand the critical role SEO plays in the success of financial service providers. Our partnership with Canvas Credit Union is a prime example of how targeted strategies can achieve remarkable outcomes. By implementing a localized SEO strategy and optimizing key product pages, we helped Canvas increase traffic to targeted pages by 191-702%. Most impressively, conversion page traffic multiplied by 5X, directly boosting their ability to connect with new members and serve existing ones.

These results stemmed from our detailed approach to understanding customer needs, conducting thorough keyword research, and enhancing website usability. For branch location pages, we ensured local discoverability by incorporating drive-through ATM and co-op shared branch details, resulting in 37% growth in local search traffic. For financial product pages, we restructured layouts, highlighted rates, and integrated FAQs to match user intent. Our data-driven collaboration increased visibility and reinforced Canvas Credit Union’s credibility as a trusted financial resource in the community.

We’re ready to bring this level of expertise and measurable success to your organization.

SEO Strategy for Financial Services: A Primer

A well-crafted SEO strategy builds trust, attracts quality leads, and stands out in a competitive market. With customers relying heavily on search engines to research and compare financial products, having a strong online presence is no longer optional—it’s vital. With a strong SEO strategy, your financial institution can connect with its target audience at key points in their decision-making process, driving visibility and conversions.

Next, we’ll explore the fundamentals of financial services SEO, including what it is, its benefits as a marketing channel, and why a tailored strategy is critical for success in this industry.

What is Financial Services SEO?

Financial services SEO means optimizing an institution’s online presence to rank higher in search engine results for specific and highly relevant keywords. These might include search terms like “mortgage rates,” “financial advisors near me,” or “best credit unions.”

By tailoring SEO strategies to the unique needs of financial service providers, such efforts ensure that when potential clients are looking for solutions, the firm’s website, branch locations, or services appear prominently in their search results.

SEO boosts visibility and also fosters trust by positioning companies as authoritative, dependable resources. Through strategic content marketing, SEO can enhance credibility by addressing customer pain points or providing clear explanations of complex financial products.

Why is an SEO Strategy Important for Financial Services?

An SEO strategy is vital for financial service companies seeking to thrive in an increasingly competitive and digitally-driven marketplace. By improving visibility on search engines, SEO ensures that financial institutions appear exactly when potential customers are searching for solutions like “low-interest loans” or “financial planning services.” This is a critical moment when decisions are being made, and appearing in the top results positions a company as a trusted and accessible option.

The financial services industry is highly competitive, with both traditional providers and fintech disruptors vying for customer attention. A strong SEO strategy, crafted by a specialized SEO agency for financial services, helps companies differentiate themselves by capturing organic traffic and boosting local search rankings for branch locations or service areas.

This is especially useful for institutions with physical branches aiming to connect with customers in their communities. An optimized digital presence makes services easier to find online, which levels customer barriers.

Financial Services Marketing Challenges

There are unique challenges to marketing financial services that set the industry apart from others. You must navigate strict regulatory frameworks and simplify complex products, along with a myriad of other details that complicate building trust and connecting with customers.

The following sections will explore some of the most pressing obstacles faced by financial service companies today. Understanding these hurdles is key to crafting effective and compliant marketing strategies that deliver real impact.

Regulatory Compliance

Regulatory compliance is one of the most significant challenges for marketing in the financial services sector. Financial institutions operate in a tightly regulated environment, requiring all marketing efforts to carefully adhere to legal standards such as GDPR, FINRA guidelines, and other industry-specific laws. These regulations are important: they’re designed to protect consumers, but they can sometimes limit marketing creativity, as every message must be transparent, accurate, and free from misleading claims. Even a small oversight in compliance can lead to hefty fines, reputational damage, or a loss of consumer trust.

To succeed within these constraints, marketers in financial services must prioritize clarity and accuracy in their campaigns. This means thoroughly vetting content to ensure it aligns with legal obligations while still engaging and educating potential customers. Achieving this balance requires a deep understanding of the current regulatory landscape, as well as close collaboration between marketing, legal, and compliance teams. When done effectively, compliance-focused marketing not only mitigates risks but also fosters trust and credibility—essential qualities in financial services.

Complex Products and Services

Financial services often involve intricate products such as investment portfolios, insurance policies, and retirement plans, which can be challenging for consumers to fully grasp. The complexity lies in the specialized terminology, layered options, and nuanced benefits that often accompany these offerings. For marketers, this presents a dual challenge—explaining these products in a way that makes sense to potential clients while maintaining the technical accuracy required in this heavily regulated industry.

To overcome this hurdle, financial marketers must craft messaging that simplifies complex concepts without diluting their essence. This might involve breaking down products into digestible parts, utilizing visuals to illustrate ideas, or creating educational content that builds awareness and confidence among customers. The goal is to engage potential clients through clear communication, helping them feel informed and empowered to make decisions. By striking this balance between simplicity and precision, you can successfully connect with your audience and build lasting relationships.

Long Sales Cycles

Decisions such as selecting a mortgage, investment plan, or insurance policy aren’t made on a whim—they require substantial time, research, and deliberation. Customers often need to compare options, consult with experts, and evaluate their financial goals before committing, which can significantly extend the time from initial contact to conversion. For marketers, this means traditional “quick-win” strategies may not suffice.

To address this, financial marketers must focus on nurturing leads over time through consistent engagement. Building trust is paramount, as customers are more likely to choose a provider they perceive as reliable and knowledgeable.

The key is to create valuable content such as educational blogs, webinars, and personalized communications that address their concerns and provide actionable insights. By maintaining a strong, supportive presence throughout the decision-making process, financial institutions can remain top-of-mind and foster the trust needed to ultimately convert potential clients into loyal customers.

Attracting Younger Demographics

Attracting younger demographics, such as Millennials and Gen Z, is a growing challenge for financial services marketers. These generations often have different financial priorities compared to older age groups, focusing more on student loans, saving for experiences, and navigating the gig economy. They also expect seamless, digital-first interactions and personalized solutions tailored to their specific needs. Traditional marketing approaches may fail to resonate with this tech-savvy audience, who value convenience, transparency, and authenticity in their financial relationships.

To effectively connect with younger customers, financial services must meet them where they are—on social media platforms, mobile apps, and digital channels. Engaging campaigns that incorporate relatable storytelling, interactive tools, and user-friendly financial education can help build trust and loyalty. Additionally, offering personalized experiences, such as budgeting apps or insights powered by artificial intelligence, can position financial institutions as valuable partners in achieving their financial goals. A focus on innovation and adapting to this audience’s preferences is crucial for building long-term relationships with the next generation of clientele.

Digital Transformation

The digital transformation sweeping through the financial services industry presents both opportunities and challenges for marketers. To stay competitive, financial institutions must modernize their marketing strategies, leveraging new technologies and platforms to engage increasingly tech-savvy consumers. This often involves adopting tools such as artificial intelligence, automation, and advanced analytics to deliver personalized and efficient customer experiences. However, the shift to digital is complex, requiring seamless integration with legacy systems—a task that can be resource-intensive and time-consuming.

Beyond technological hurdles, ensuring data security and maintaining customer trust remain top priorities. Customers expect their financial interactions to be not only convenient but also safe and secure. Working with a digital marketing agency for financial services ensures that financial institutions can design intuitive, user-friendly digital interfaces that meet evolving customer expectations. From mobile banking apps to interactive websites, marketers must find innovative ways to meet evolving customer expectations while retaining the human touch that fosters loyalty. Balancing these priorities is key to navigating the digital transformation successfully and maintaining a competitive edge.

Competition from Fintech Companies

The rise of fintech companies has dramatically reshaped the financial services landscape, creating a significant challenge for traditional institutions. Fintechs are disrupting the industry with their innovative, user-friendly solutions that cater to tech-savvy consumers seeking convenience, speed, and seamless digital experiences. Their ability to harness cutting-edge technologies like artificial intelligence, blockchain, and data analytics allows them to offer personalized services and competitive pricing, capturing the attention of younger generations and small businesses that prioritize agility and modern interactions.

For traditional financial institutions, staying competitive requires a strategic response. They must differentiate themselves by emphasizing their established strengths—trust, reliability, and proven track records—while also modernizing their services to meet evolving customer expectations. Adopting advanced technologies, improving digital platforms, and offering hyper-personalized customer experiences are crucial steps. Additionally, showcasing their expertise in navigating complex financial needs and providing human-centered support can help traditional players carve out a unique value proposition that fintechs can’t replicate. By blending their heritage with innovation, traditional financial institutions can remain relevant and competitive in an increasingly fintech-driven market.

Data Utilization and Integration

Effectively utilizing and integrating data is a complex but essential challenge for financial services marketers. Financial institutions often gather vast amounts of customer data from disparate sources, including transaction histories, credit reports, and digital interactions. However, consolidating and managing this data to create a unified, actionable view of the customer requires advanced tools and seamless integration across platforms. Without this, valuable insights remain siloed, limiting the institution’s ability to deliver the tailored experiences customers now expect.

Data analytics plays a crucial role in transforming raw information into meaningful insights that support personalized marketing strategies. By leveraging machine learning and predictive analytics, financial institutions can anticipate customer needs and provide relevant recommendations.

However, the process of utilizing data must also prioritize strict adherence to privacy regulations and ensure robust security measures to build and maintain trust. Successfully navigating these challenges allows financial services companies to unlock the full potential of their data while fostering increasingly personalized and secure relationships with their customers.

Proving Marketing ROI

Proving marketing ROI is a persistent challenge in the financial services industry, given the intricacies of its offerings and extended sales cycles. Unlike consumer goods, where the impact of a campaign may be more immediately measurable, financial decisions like choosing a mortgage, investment portfolio, or insurance policy are drawn-out processes. This makes it difficult to connect specific marketing efforts directly to revenue generation. The variety of touchpoints, from initial awareness campaigns to long-term lead nurturing, adds another layer of complexity in attributing success to any single initiative.

To address this, financial institutions need to adopt advanced analytics tools and tracking strategies that provide a clearer picture of the customer journey. Defining relevant KPIs—such as lead engagement levels, conversion rates, or customer retention metrics—can help quantify the impact of marketing activities. Additionally, integrating sophisticated attribution models can untangle the contributions of different channels, showing which efforts yield the best results. By using data-backed insights and fostering a culture of measurement, marketers can not only justify their investments but also refine their strategies to maximize long-term growth and success.

How to Build an SEO Strategy for Financial Service Companies

Search engine optimization (SEO) is an essential tool for financial service companies looking to thrive in a highly competitive digital landscape. With more consumers relying on online research to find financial solutions, having a strong SEO strategy ensures your company ranks high on search engine results pages (SERPs), improving visibility and attracting qualified leads. By following a structured approach, financial institutions can create a sustainable SEO plan that not only drives traffic but also supports long-term business growth. Below are the five key steps to building an effective SEO strategy in the financial services industry.

1. Research

The foundation of any effective SEO strategy is thorough research. For financial service companies, this involves analyzing industry trends, understanding target audience behavior, and identifying the keywords and phrases prospects are searching for. Competitor analysis plays a critical role here too, as it helps uncover gaps and opportunities to position your brand effectively. This step ensures that your SEO efforts are data-driven and targeted to meet the unique needs of your market.

2. Establish Goals and KPIs

Whether your objective is increasing organic traffic, generating leads, or improving conversion through PPC agency services for financial service companies, defining these metrics provides a clear roadmap for your efforts. Setting realistic and specific goals helps financial service companies focus their resources effectively and ensures that every SEO action aligns with broader business objectives.

3. Plan and Schedule

A strategic plan is essential to guide your SEO efforts over time. This step involves creating a content calendar, identifying technical SEO improvements, and outlining link-building initiatives. For financial service companies, the plan should prioritize high-value content such as blogs, whitepapers, and calculators that resonate with your audience. A well-organized schedule ensures consistency, keeps your team aligned, and allows for adaptability as market conditions evolve.

4. Execute

With a solid plan in place, the next step is execution. This includes optimizing website content, publishing valuable resources, improving site speed, and ensuring mobile responsiveness, tasks that are part of a comprehensive strategy from an experienced SEO agency. Building backlinks, optimizing metadata, and improving technical SEO are also critical here. For financial services, execution must be meticulous because trust and professionalism are vital to attracting prospects. A seamless website experience combined with high-quality content fosters credibility and encourages user engagement.

5. Assess and Improve

SEO is an ongoing process, and regularly assessing performance is essential for sustained success. Using analytics tools, financial service companies can track progress against their KPIs, measure what’s working, and identify areas for improvement. Regular audits of content, keywords, and technical SEO help fine-tune your approach and address emerging trends. Continuous optimization ensures that your strategy remains effective in a dynamic digital environment.

SEO Strategies, Tactics, and Insights for Financial Services

A tailored SEO strategy can help your financial institutions enhance visibility, generate qualified leads, and stand out as authoritative providers in a saturated marketplace. Below are six key strategies to create an effective and sustainable SEO approach specifically for the financial services sector.

Establish a Solid Technical SEO Foundation

The foundation of any successful SEO strategy lies in technical optimization. For financial services, this means ensuring your website operates seamlessly, is easy to browse, and complies with modern security protocols.

- Create a Logical Website Architecture: A well-organized website architecture is essential for both user experience and SEO success. Financial service companies should structure their websites into clear, intuitive hierarchies that prioritize key service pages like mortgage options, loan calculators, or investment tools. This makes it easier for visitors to find important information quickly, while helping search engines understand the relationship between different parts of the site.

- Ensure Crawability and Indexation: To rank well on search engines, financial service websites must ensure that their content is easily crawlable and indexable. This includes creating an XML sitemap, using robots.txt files effectively, and avoiding duplicate content that can confuse search engines.

- Focus on Enhanced Security: Strong website security is a non-negotiable for financial service companies, not only to protect sensitive customer data but also to boost SEO rankings. HTTPS protocols are a must, as they are favored by search engines and reassure visitors about the safety of the site. Beyond encryption, financial institutions need to focus on secure payment gateways, regular vulnerability assessments, and compliance with regulations like GDPR or GLBA.

- Leverage Structured Data Markup (Schema): Structured data markup enables search engines to understand and present website content more effectively in search results. For financial service companies, schema can be used to showcase detailed information such as loan rates, client testimonials, service offerings, and contact details. This enhances the visibility of featured snippets and rich results, helping your website stand out on search engine results pages (SERPs).

Conduct Keyword and Topical Research

Keyword and topical research is essential for uncovering the terms and questions your target audience uses during their financial decision-making journeys. Financial service companies must segment keywords by intent, leverage their niche expertise to target relevant terms, analyze paid-search data for high-converting keywords, and refine their strategies for specific channels like mobile and voice search.

- Segment Keywords & Topics by Intent: Categorizing keywords by their purpose—whether users are seeking information (informational), comparing options (navigational), or ready to take action (transactional)—helps you build useful content. For example, a user searching for “what is a mortgage” needs educational content, while someone searching “apply for a mortgage near me” has transactional intent and requires easy access to service pages. Mapping content to these intents ensures that your website serves the needs of potential customers at every stage of their decision-making process.

- Leverage Niche Industry Expertise: Financial service companies possess unique knowledge that can be leveraged to dominate niche keyword spaces. By tapping into industry-specific expertise, businesses can identify specialized terms and questions—such as “fixed-rate vs. adjustable-rate mortgage calculator”—that resonate deeply with their target audience. This approach drives relevant traffic and establishes your company as a trusted authority. Delivering valuable insights through content, tailored to these keywords, encourages search engines and users to prioritize your site.

- Assess Paid-Search Insights for Converting Keywords: Analyzing paid-search campaigns can uncover high-converting keywords that drive measurable results. Examining which terms lead to clicks and conversions in paid ads, lets you refine your organic SEO efforts to focus on similar phrases. For instance, if paid data reveals strong performance for “low-interest personal loans,” businesses can create organic content targeting this term, such as blogs, FAQs, or landing pages. This method ensures that organic strategies are aligned with proven customer interests, boosting traffic and conversions while maximizing the ROI of overall marketing efforts.

- Implement Channel-Specific Keyword Strategies: Different channels demand tailored keyword strategies, especially for financial service companies aiming to optimize reach and engagement across platforms. For mobile searches, optimizing for location-based queries like “financial advisors near me” is key. Tailoring strategies for social media may involve hashtags and short-tail keywords, while visual-heavy platforms might benefit from keywords around visual content. Adapting to the needs of each channel ensures your SEO efforts reach customers where and how they search for answers.

Optimize for Financial SERP Features

SERPs have come a long way from the list of blue links! Financial brands must optimize for features like “People Also Ask” sections, image and video packs, and featured snippets. These features provide valuable opportunities to capture prime digital real estate, showcase expertise, and draw attention to your brand. Creating engaging, optimized content for these features can significantly boost online visibility and authority in the competitive financial space.

- Answer “People Also Ask” (PAA) Questions: Create content that directly addresses common queries like “What is the best savings account?” or “How do mortgages work?” These questions typically appear at the top of SERPs, making them prime real estate for driving traffic to your site.

- Develop Content for Image/Video Packs: Visual content is increasingly influential in SERPs, and financial service companies can benefit by producing high-quality visuals like infographics, explainer videos, or tutorials. Complex finance topics, such as investment strategies or tax preparation, can be simplified and made more engaging with graphics or short videos.

- Create a Google Knowledge Panel: A Google Knowledge Panel is an excellent way for financial service companies to establish authority and consolidate their brand identity in search results. To activate a panel, businesses should claim and verify their Google Business Profile, provide accurate and consistent information across web listings, and ensure their website exudes credibility. Including comprehensive details, like company history, leadership, services, and awards, can boost the chances of a panel being displayed.

- Focus on AIO and Featured Snippets: Featured snippets and AI-driven search results offer opportunities to appear at the very top of SERPs—often referred to as “position zero.” Financial service companies can optimize for these placements by structuring content with concise, direct answers to commonly searched questions. Using bullet points, numbered lists, or tables for topics like “steps to apply for a loan” or “comparison of credit card features” improves clarity and makes the content snippet-friendly.

Determine Your Content Strategy

A strong content strategy drives the quality and relevance behind any SEO effort. Financial service companies should align their topics with insights about their ideal client profiles (ICPs), tailor their content creation approach to specific channels, diversify content types like blogs, infographics, and tools, and emphasize Experience, Expertise, Authority, and Trustworthiness (EEAT) to meet the Your Money Your Life (YMYL) standards that Google prioritizes.

- Align Topics with ICP Insights: Aligning content topics with Ideal Customer Profile (ICP) insights is crucial for creating relevant and engaging materials. For financial service companies, this means understanding the unique needs and pain points of different customer segments, such as first-time homebuyers, small business owners, or retirees. For example, content targeting first-time homebuyers could focus on mortgage basics and budgeting tips, while resources for small business owners might explore financing options and cash flow management. By addressing these specific concerns, financial institutions can build trust and strengthen their connection with diverse audiences.

- Develop a Channel-Specific Approach: Content strategies must be tailored for the unique demands of various platforms to maximize reach and engagement. Financial service companies can effectively use LinkedIn to share in-depth thought leadership articles or B2B-focused resources targeting corporate clients. Meanwhile, Instagram is optimal for sharing concise financial tips or engaging infographics aimed at younger audiences entering the financial market. Aligning content formats and styles to each channel’s audience preferences ensures consistent messaging while also leveraging the strengths of individual platforms to cultivate meaningful connections.

- Plan Content Types: Diversifying content types is essential for capturing different audience preferences and improving overall engagement. Financial service companies can benefit from a mix of blogs, videos, whitepapers, and interactive tools. For instance, blogs can explain investment strategies, while videos might demonstrate how to use financial planning apps. Interactive tools like loan calculators or budget planners provide immediate value, and webinars or case studies can establish expertise in more complex topics. A varied content strategy not only keeps the audience engaged but also improves visibility across multiple touchpoints.

- Demonstrate EEAT for YMYL: Financial service content falls into the “Your Money or Your Life” (YMYL) category, requiring demonstrated Expertise, Authoritativeness, and Trustworthiness (EEAT) to rank well and gain consumer trust. Companies should feature credible experts or licensed advisors as content authors and back claims with verifiable data from reliable sources. Transparency is key, whether explaining product terms or providing investment advice, to ensure customers feel secure and informed. By adhering to EEAT principles, financial service businesses can deliver value while earning the trust of both search engines and their target audience.

Build Consumer Confidence with EEAT

EEAT is particularly critical for financial institutions, where trust is non-negotiable. Establishing expertise with subject matter expert (SME) content, boosting authority signals like certifications and awards, earning backlinks from credible sources, and sharing success stories all help build confidence in your brand. A strong EEAT focus not only improves SEO but also reassures potential customers of your legitimacy and reliability.

- Publish SME Content: Publishing content authored by Subject Matter Experts (SMEs) is vital for financial service companies aiming to earn consumer trust and build credibility. Featuring licensed advisors, financial analysts, or tax specialists allows companies to address complex topics such as retirement planning, investment diversification, or tax-saving strategies with authority. For example, a blog or video created by a certified financial planner can provide clear, actionable advice while reassuring readers that they’re receiving guidance from a trusted professional. SME-driven content not only improves audience confidence but also signals expertise to search engines, boosting overall visibility.

- Boost Authority Signals: Enhancing authority signals is a key tactic for building trust with consumers and improving SEO rankings. Financial service companies can achieve this by highlighting partnerships with regulatory bodies, certifications, and endorsements from well-known institutions. Displaying affiliations with organizations like FINRA, SEC licensure, or certifications like CFP (Certified Financial Planner) assures clients of the company’s legitimacy. Awards and accolades, such as “Top Investment Firm” recognitions, also add weight to a brand’s reputation. Incorporating these elements into web copy and marketing materials demonstrates reliability and expertise, helping to establish a strong competitive advantage.

- Earn Backlinks from Reputable Publications: Backlinks from trusted sources play a crucial role in demonstrating authority and building trustworthiness online. Financial service companies can earn these links by contributing guest articles to reputable financial news outlets, such as Forbes or Bloomberg, or by being cited in industry research reports. Additionally, partnerships with academic institutions or non-profits for research efforts can lead to valuable backlinks. For example, publishing insights on economic trends could attract attention from journalists or bloggers referencing your expertise. These high-quality links not only improve domain authority but also direct motivated, high-intent traffic to your website.

- Showcase Client Success Stories: Client success stories and testimonials are powerful tools for building trust and illustrating the real-world benefits of your services. Financial service companies can develop case studies that detail how clients achieved their goals, whether it’s funding their child’s education through smart savings plans or paying off debt with tailored strategies. Adding client quotes or video testimonials provides an authentic touch, showcasing the human impact of your offerings. These stories not only resonate emotionally with prospective clients but also reinforce the company’s trustworthiness and effectiveness, making them an essential part of your EEAT approach.

Leverage Local SEO

For financial services that serve specific regions or communities, local SEO is a powerful tool. Optimizing your Google Business Profile, creating location-specific landing pages, using paid-search insights to fine-tune geotargeting, and managing local citations and reviews are essential steps for improving visibility to nearby prospects. Local SEO ensures that your brand stands out to users searching for financial solutions in their area.

- Optimize your Google Business Profile: Optimizing your Google Business Profile is a critical step for boosting local SEO efforts. Financial service companies should ensure their profiles include accurate business hours, a complete list of services, and customer-focused descriptions. Adding high-quality images of local branches, customer testimonials, and up-to-date contact information creates a trustworthy first impression and helps clients find relevant details quickly.

- Create Location-Based Landing Pages: Creating location-based landing pages allows financial service companies to directly connect with customers in specific regions. These pages can showcase branch-specific services, local financial advisors, and relevant offers, helping establish a personalized connection with the audience.

- Assess Paid-Search Insights for Geotargeting: Analyze data from ad campaigns to identify regions or cities where demand for services like loans, investments, or tax advisory is particularly high. For example, if a paid campaign reveals strong engagement from urban professionals in Chicago, the company can optimize local ads, landing pages, and offers for that audience.

- Manage Citations and Reviews: Managing online citations and customer reviews is essential for building trust and improving local search rankings. Financial service companies should ensure that their NAP (Name, Address, Phone Number) details are consistent across directories such as Yelp, Bing, or industry-specific platforms like FINN. Actively responding to client reviews—whether positive or negative—helps establish credibility and shows a commitment to customer service.

Inform Your Efforts with Analytics Data

Analytics provides the insights needed to refine and amplify your strategy over time. Financial service companies should implement custom event tracking to monitor engagements, use cohort analysis to understand content performance, track shifting search intent signals, and analyze historical trends to forecast future SEO efforts. Leveraging data allows for smarter, more strategic optimizations that improve results continuously.

- Implement Custom Event Tracking: Custom event tracking is a vital tool for financial service companies to gain deeper insights into user behavior and measure the effectiveness of their digital strategies. By setting up custom events on their websites, companies can track specific interactions such as clicks on loan calculators, form submissions for credit card applications, or downloads of retirement planning guides.

- Use Cohort Analysis to Track Content Engagement: Cohort analysis helps financial service companies understand how specific groups of users engage with content over time. By grouping visitors based on shared characteristics, such as when they first interacted with the site, companies can identify patterns in user behavior.

- Monitor Search Intent Changes: Search intent constantly evolves, and financial service companies must stay on top of these changes to keep their content relevant. Monitoring shifts in search behavior, like an increased focus on inflation, interest rates, or economic policies, allows companies to anticipate customer concerns and update their content accordingly.

- Use Historical Data to Forecast Performance: Leveraging historical data enables financial service companies to predict future trends and refine their strategies for greater impact. Past data from campaigns, site traffic, or search queries can reveal seasonal patterns, such as spikes in demand for tax preparation services in the first quarter or mortgage inquiries in the summer.

Win High-Intent Searches with Session Interactive

At Session Interactive, we excel at helping fintech companies overcome their most pressing SEO challenges, like navigating regulatory compliance, building customer trust, and breaking through in a competitive market. Our team brings years of experience to craft tailored strategies designed specifically for your needs, delivering measurable results that drive meaningful growth. Whether we’re creating ppc strategies for our fintech clients, creating authoritative content, or leveraging data-driven SEO and CRO techniques, our approach is always transparent and precise. When you partner with us, you gain more than just an SEO agency—you gain a team of experts committed to helping your fintech brand thrive.

Request a consultation with Session Interactive today and discover how our tailored strategies can transform your SEO efforts into measurable results.