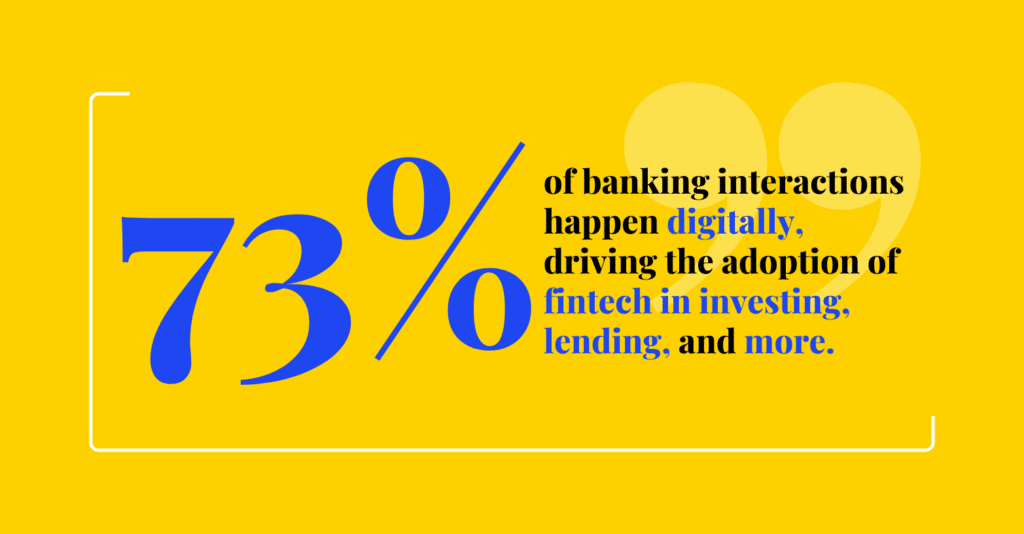

The fintech industry continues to surge ahead even as equity financing has dropped. Over the past decade, it has grown from a fringe disruptor to a core player in global financial services, with revenues projected to hit an astonishing $1.5 trillion by 2030. This reflects a remarkable 14% annual growth rate, even as the market trades hypergrowth for sustainability. With 73% of global banking interactions now happening through digital channels, consumer habits are shifting fast, paving the way for the rise of fintech applications in investing, lending, and beyond.

Crucial technological advancements—like generative AI—are driving this expansion, transforming everything from customer service to product development. There is also a growing appetite for connected commerce and embedded financial solutions. However, fintech faces mounting challenges, including increasing regulatory scrutiny, cost discipline, and a demand for more sustainable growth models. The opportunity remains vast, but realizing it will require fintech to stay laser-focused on customer needs. Marketing helps bridge that gap.

This article will guide you through the essentials of fintech marketing. We’ll explore fintech companies’ challenges, the benefits of a well-rounded marketing strategy, and ten actionable strategies to drive sustainable growth in this competitive landscape. Let’s get started.

In this guide:

As an experienced digital marketing agency for fintech companies, we have built a proven track record of driving digital marketing success for fintech companies. Our team has deep expertise in tackling fintech brands’ unique challenges, from enhancing visibility in crowded markets to building trust in sectors where credibility is everything.

We’ve partnered with clients to craft tailored fintech SEO strategies that boost organic search rankings, develop compelling content marketing campaigns that educate and engage users, and hone audience targeting strategies to connect with high-value prospects.

Fintech Marketing Challenges

Fintech marketers face a range of unique challenges—particularly startups trying to carve out their place in a rapidly evolving market. From building awareness and trust to standing out in a crowded space, fintech companies face an uphill battle to scale effectively. High customer acquisition costs, the need to educate users about complex products, and the rapid pace of the industry add to the complexity. Addressing these hurdles requires a strategic approach rooted in both clarity and creativity.

Below, we outline the most pressing marketing challenges fintech companies encounter and why overcoming them is critical for sustained growth.

Establishing Brand Awareness, Trust, and Credibility

For fintech companies, trust isn’t just nice to have—it’s non-negotiable. Consumers handing over sensitive financial data demand reliable platforms with a rock-solid reputation. Yet, startups often struggle to establish credibility in an industry where security breaches or failed models leave lasting scars.

Fintechs must demonstrate that they’re as dependable as their legacy competitors. Clear messaging, customer success stories, and transparent practices are essential for steering perceptions toward trust and security.

Beyond trust, building brand awareness in the noisy fintech ecosystem is a challenge of its own. Startups with limited budgets need creative strategies—such as leveraging social proof or industry partnerships—to gain visibility and credibility in the eyes of skeptical consumers.

Market Saturation

The fintech space is fiercely competitive, with thousands of companies vying for attention. New entrants must compete with peers in their niche and take on well-funded global players with established footholds. Market saturation means startups must figure out how to differentiate their products, communicate unique value propositions, and stand out against lookalike offerings.

Despite industry growth, connected commerce and embedded financial services are increasingly dominated by major players like banks, squeezing opportunities for smaller fintech companies. These dynamics force companies to refine their positioning and double down on consumer-specific pain points to gain traction in a cluttered market.

Customer Acquisition Costs (CAC)

The fintech sector’s digital nature means marketing largely happens online—where competition drives costs. Whether it’s paid ads, influencer campaigns, or direct outreach, the price of acquiring each customer can quickly eat into profits. Unfortunately, high CAC is a reality for many fintech startups, especially when targeting niche audiences through competitive channels.

Building efficiencies in the funnel—through tactics like A/B testing, retargeting, and cross-selling—helps improve customer lifetime value (LTV) relative to acquisition costs. But for startups without deep pockets, this remains a steep challenge.

Audience Targeting

Fintech companies cater to a remarkably diverse audience. They encompass everyone from Gen Z investors to underbanked populations and even SMEs seeking tailored solutions. This diversity makes targeting tricky—it’s challenging to craft messaging that resonates universally while addressing specific customer pain points.

Regional nuances add further complexity. Crafting audience-specific campaigns with tailored messaging and product offerings is essential (but resource-intensive!)

Educating Customers

Fintech products can be intimidating or confusing for first-time users. When explaining ideas like blockchain solutions or embedded finance, companies must be efficient educators. However, educating users requires thoughtful content, tools, and resources, which not all startups have the bandwidth to produce.

The gap in understanding prevents many from fully utilizing fintech innovations, particularly in underserved markets. Efforts such as creating explainer videos, webinars, or interactive tools can bridge this gap—but scaling such educational initiatives poses challenges.

Customer Retention

Retention is a growing pain in fintech, especially with switching costs at an all-time low. With competitors continually offering better rates, improved UX, or added features, staying top-of-mind is no easy feat.

To improve retention, companies need more than just strong initial onboarding. Loyalty programs, personalized offers, and customer engagement strategies, such as proactive support, are critical. However, balancing these efforts against budget constraints is a persistent problem for newer entrants in the space.

Adapting to Fast-Paced Tech Advancements

Few industries change as quickly as fintech. Firms need to constantly adapt to innovations like generative AI, open banking integrations, and blockchain technology—or risk falling behind. While these advancements unlock opportunities, they also complicate marketing and development cycles. Integrating emerging tech into campaigns requires agility and expertise, which lean teams may lack.

For instance, McKinsey highlights how generative AI is transforming marketing by automating operational workflows and delivering hyper-personalized ad targeting at scale. Fintechs that fail to implement such tools risk being outpaced by savvier competitors.

Achieving Revenue Goals

Underlying all these challenges is the ultimate aim of meeting ambitious growth targets. Unlike traditional industries, fintech companies are expected to scale rapidly while balancing revenue and customer satisfaction. As time passes, profitability is increasingly vital, with most public fintechs falling short of EBITDA thresholds.

Sustainable growth requires better cost discipline and innovative revenue streams, such as subscription models or connected commerce solutions. This balancing act makes hitting revenue milestones that much harder for new entrants navigating a fiercely competitive environment.

Addressing these interconnected challenges will allow fintechs to cement their place in the financial ecosystem. But without pragmatism and precision, even the most innovative products might struggle to achieve meaningful traction.

The Benefits of a Comprehensive Fintech Marketing Strategy

How can you address the challenges in the previous section? With a comprehensive marketing strategy.

By aligning messaging, targeting, and execution, fintech companies can effectively build trust, reduce customer acquisition costs, and retain loyal users—all while staying agile in the face of rapid industry advancements. Thoughtful marketing tackles specific pain points like brand awareness and market saturation and acts as a catalyst for sustainable growth and profitability.

Below, we explore how a well-rounded fintech marketing approach delivers these benefits and empowers companies to thrive.

Increased Brand Awareness

For fintech companies, especially startups, breaking through the noise requires a proactive approach to building visibility.

A comprehensive marketing strategy, rooted in storytelling and digital engagement, enables fintechs to showcase their value proposition clearly and convincingly. With a mix of social media, SEO, industry partnerships, and PR, companies can strategically put their brand in front of their target audiences at the right time. Trust and credibility are critical in an industry where users are cautious about sharing personal financial data. A holistic strategy that incorporates customer testimonials, security certifications, and transparency helps create authenticity.

For example, publishing thought leadership content that explores industry trends can position your company as an authority in the space.

Improved Visibility Among Competitors

The fintech space is crowded, with new players constantly emerging and established ones claiming market share. To stand out, a strong marketing strategy helps companies identify their unique selling points and package their offerings in a way that aligns with consumer priorities. Competitive audits paired with targeted campaigns can highlight what makes a fintech solution not just different but indispensable.

Take niche positioning as an example. A startup focusing on mobile-first banking for Gen Z could differentiate itself by speaking directly to the pain points of financially underserved younger audiences. Thoughtful segmentation, coupled with creative advertising like educational reels or influencer partnerships, can help position the brand with clarity and memorability.

Reduced Customer Acquisition Costs

Acquiring new customers is notoriously expensive in fintech, but a comprehensive marketing strategy can optimize the process. For instance, integrating data analytics and customer segmentation tools helps your campaigns target users who are the most likely to convert.

Consider an investment in SEO and content marketing. It tends to have a longer-term ROI compared to paid advertising. Fintechs that focus on balancing lifetime customer value (LTV) with acquisition costs see better unit economics over time. Campaigns that repurpose educational content or emphasize referrals often yield higher efficiencies at a fraction of traditional CAC.

Enhanced ICP Targeting

Understanding and reaching your ideal customer profile (ICP) is at the heart of an effective fintech marketing strategy. A one-size-fits-all approach doesn’t work in a field where audiences range from tech-savvy millennials to cautious retirees. Tailored marketing allows fintech companies to craft specific messages for each segment, lending relevance and resonance to campaigns.

Advanced audience profiling tools, combined with AI-driven personalization, can help fintechs refine their targeting down to the smallest details. For example, a lending platform might target first-time homeowners with one campaign, while directing separate ads to small business owners. Drilling down into different demographics and regional preferences, to create tailored engagement that drives better results.

Better Informed Customers

Education is so important to onboarding new customers, given the often-complex nature of fintech products. From explaining how a robo-adviser works to showcasing the benefits of embedded finance solutions, you need clear customer education to minimize confusion and build trust. A comprehensive marketing strategy incorporates educational videos, FAQs, blog posts, and onboarding materials to meet these needs.

By demystifying fintech features, companies reduce barriers for potential users hesitant to adopt unfamiliar technology. For instance, interactive guides or case studies that explain the tangible benefits of a service can turn skeptics into advocates, leading to faster time-to-value and a more loyal customer base.

Less Customer Churn

Retention matters just as much as acquisition, and a sound marketing strategy ensures that customers stay engaged after the initial sign-up. Loyalty programs, personalized recommendations, and proactive customer service are only part of the equation. Fintechs can also use consistent email campaigns, alerts on updates or new features, and exclusive promotions to keep customers feeling valued.

Customer churn becomes less of a threat when companies invest in personalization. AI-driven insights allow marketers to predict when a customer might disengage and deploy targeted interventions, such as tailored offers. For example, a personal finance app might provide guidance on maximizing rewards or saving habits based on an individual’s behavior patterns. These efforts cultivate long-term relationships and reduce costly departures.

Improved Ability to Scale Marketing Efforts

The fintech industry evolves quickly, and a comprehensive marketing strategy equips companies with the tools to scale as needed. With advancements like generative AI automating repetitive tasks, fintech marketers can focus on strategic decision-making. Scaled campaigns can adapt messaging seamlessly to new platforms, geographies, or demographics without missing a beat.

Automation tools, such as AI-driven content production or customer interaction platforms, help fintechs widen their reach while maintaining precision. Whether it’s entering a new market or launching a fresh campaign, scalability becomes manageable with the right framework in place. Flexibility ensures companies stay competitive without exhausting resources.

Increased Profitability

A targeted and comprehensive marketing strategy aligns efforts directly with revenue goals, helping fintechs grow their market share and improve efficiency simultaneously. By focusing on retention alongside acquisition, you unlock more revenue per customer, creating compounded effects on profitability. Marketing strategies that focus on nurturing customer relationships, cross-selling, and long-term loyalty contribute directly to the bottom line, making securing tangible ROI from every initiative easier.

Plus, a thoughtful marketing strategy prepares companies for sustained industry leadership. By combining creativity, data, and scalability, fintechs can achieve their goals while navigating the complexities of an expanding market.

10 Actionable Digital Marketing Strategies to Drive Fintech Growth

Digital marketing drives growth for fintech companies, offering the tools to address pressing challenges such as customer acquisition, trust-building, and market differentiation. With sophisticated strategies, you can attract and retain customers effectively, improve profitability, and maintain an edge in a competitive space. Below, we explore ten actionable marketing strategies to help fintech companies overcome obstacles and unlock growth potential.

1. Develop a Unique Value Proposition

A unique value proposition (UVP) is your fintech’s north star—defining what makes you indispensable to your audience. Drawing on ICP research and a deep understanding of customer pain points, fintechs can craft a UVP that resonates. For example, a neobank could stress “zero fees” and “instant access” in response to frustrations with legacy banking.

Tailoring your UVP often involves blending financial behaviors and emotional drivers. Consider positioning your service as a tool of empowerment, like a budgeting app emphasizing financial independence for young professionals. Every communication—whether on your homepage or through advertisements—should echo this specific, compelling narrative.

2. Conduct In-Depth Research to Identify Most Profitable ICPs

Understanding your most valuable customers starts with comprehensive research. Analyze customer data such as demographics, spending habits, and digital behaviors to refine your ideal customer profiles (ICPs) and focus on the most profitable segments. Surveys, social media analytics, and CRM data are critical tools here. For example, if your data shows consistent engagement from millennial professionals interested in wealth management solutions, your messaging and offerings can hone in on that audience.

Market research is equally important. Tools like Google Trends or competitive analysis platforms can reveal untapped opportunities. A fintech focused on B2B lending, for instance, might discover higher demand among small businesses in sectors like e-commerce and prioritize outreach accordingly. This targeted approach ensures every marketing effort yields higher returns.

3. Invest In Educational Content Marketing

Consumers are easily overwhelmed by the technical nature of fintech products. Educational content marketing can simplify the onboarding process and build trust. Blogs, webinars, and explainer videos can demystify core offerings while establishing your brand as a thought leader. A peer-to-peer lending platform could release a blog series on how borrowers benefit from bypassing traditional banks.

Interactive content is another powerful method. Budgeting tools or savings calculators invite users to engage while learning about your platform, fostering both understanding and interest—key components of long-term trust and retention.

4. Drive Product Engagement with Gamification

Gamification taps into innate human incentives like achievement and reward, making it an ideal strategy for boosting engagement and retention. Fintech apps that use visual progress trackers, badges, or tiered rewards systems keep users engaged while reinforcing positive behaviors. For example, a savings app might enable users to earn badges for hitting milestone goals.

Early-stage neobanks or investment platforms could incorporate quizzes or challenges to educate users while enhancing the user experience. These gamified elements increase time spent using the app, deepening customer engagement and loyalty in the process.

5. Improve Visibility and Authority with SEO

Search engine optimization (SEO) is fundamental to improving visibility in a highly competitive market. Fintechs can attract organic traffic by targeting relevant long-tail keywords such as “beginner investing platforms” or “low-interest small business loans.” Optimizing your website’s blog and creating pillar content pages—like “The Ultimate Guide to Personal Loans”—can position your brand as an industry leader.

Sensitivity to technical SEO factors, such as site speed and mobile optimization, is equally crucial. Consistency in publishing helpful, well-researched content ensures higher SERP rankings and long-term site authority.

6. Establish Consumer Confidence with Certifications and Partnerships

Trust is paramount in the fintech industry, and certifications like PCI-DSS compliance or partnerships with reputable financial institutions can bolster consumer confidence. Showcasing security credentials directly on your website or app can reassure potential customers. For instance, displaying “bank-level encryption” or “backed by [trusted bank partner]” signals reliability.

Collaboration with prominent networks further solidifies credibility. A fintech company entering the payments space could partner with organizations like Visa or Mastercard, lending instant authority to their offerings and reducing hesitation in first-time users.

7. Generate Quality Leads with PPC and Social Media Ads

Strategically targeted pay-per-click (PPC) and social media ads provide fintechs with a direct channel to acquire high-quality leads. Platforms like LinkedIn allow for precise targeting, ideal for B2B fintech solutions. Meanwhile, Facebook’s and Instagram’s lookalike audience features can help B2C companies reach new users resembling their current customer base.

Retargeting campaigns also offer strong ROI. A personal finance app, for example, could serve ads promoting features like credit score monitoring to users who previously visited their website but didn’t sign up, converting interest into action.

8. Maximize Digital Marketing Channels with CRO

Conversion rate optimization (CRO) ensures you’re making the most of existing traffic by funneling users more effectively toward a signup or transaction. A/B testing landing pages, simplifying form fields, or adding trust signals are small changes that can yield major improvements in conversions.

Take the example of a neobank that reduces a multi-step account setup process down to a sleek one-click registration. This optimization not only cuts user drop-offs but also aligns with user expectations for convenience in the modern financial landscape.

9. Inform Decision Making with Data Analytics

Data analytics lie at the heart of precision marketing. Tracking user behavior—such as what drives repeat logins or at what step users abandon their onboarding—enables fintechs to refine their approach. By analyzing campaign performance metrics like click-through and conversion rates, you can adjust your strategy in real time.

For example, an investment platform could use heatmaps to identify where users pause on their website, then simplify jargon-heavy sections to boost comprehension. This data-driven approach fine-tunes marketing initiatives and optimizes ROI.

10. Integrate Digital Marketing Campaigns and Channels

A multichannel approach amplifies impact by ensuring consistent brand messaging across platforms. When running a campaign for a savings product, for example, you could use email newsletters to engage existing customers, paired with social media ads to attract new users. This reinforces the message from multiple touchpoints, increasing the likelihood of conversions.

Integration also extends to internal tools—linking your CRM to your email marketing and ad platforms enables seamless customer experiences while avoiding redundancy. An omnichannel presence ensures your brand feels unified at every step of the customer’s discovery and decision-making process.

By implementing these digital marketing strategies, fintechs can tackle industry challenges head-on and carve out a lasting place in an increasingly competitive ecosystem.

Overcome Fintech Marketing Challenges with Session Interactive

Session Interactive empowers fintech companies to tackle their most pressing marketing challenges with precision. We use analytics and campaign optimization to reduce customer acquisition costs while bolstering brand visibility and trust.

Whether we’re crafting educational content or scaling multi-channel campaigns, our team creates thorough and targeted campaigns that hit your marketing goals. Work with a digital marketing agency that understands fintech.