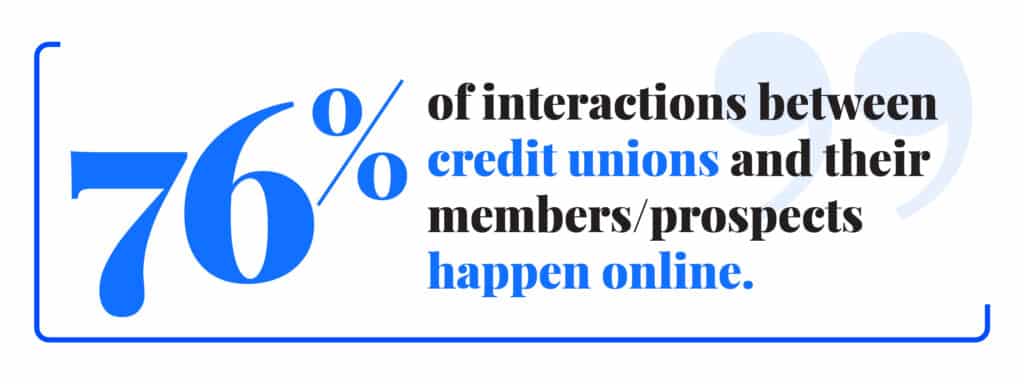

Credit unions have a huge opportunity waiting for them in digital marketing. A 2023 survey found that 76.2% of interactions between members and prospects with their credit union happen online.

With this level of digital interaction, online marketing becomes a critical investment for credit unions and other financial nonprofits.

The good news is that there’s tremendous potential to make your mark in the digital landscape. Many existing players lack the focus their efforts need to make a big impact. Their loss can be your gain, especially with guidance from an experienced digital marketing agency.

This guide will provide an in-depth look at digital marketing strategies specifically tailored to credit unions. From basic strategy development to best practices for different digital channels, we’ll cover everything you need to know to succeed. Along the way, we’ll offer tips and ideas your credit union can use in its own digital campaigns.

In this guide:

Session Interactive has over a decade of experience in digital marketing for credit unions. This experience includes SEO, PPC, and content marketing services, management, and consulting for major credit unions like Canvas Credit Union.

As a leading digital marketing agency for credit unions, we have a unique understanding of what it takes for financial nonprofits to compete with for-profit banks and other financial service providers.

Digital Marketing Strategy 101 for Credit Unions

To attract digital customers, you need a good understanding of how to get ahead of your digital-savvy competitors. In 2022, 75% of credit unions surveyed reported that digital marketing became a higher priority in the last year.

Here’s what you need to know:

What Is a Credit Union Digital Marketing Strategy?

A credit union digital marketing strategy is a comprehensive plan of action designed to achieve specific marketing objectives through online channels.

To start developing a solid digital marketing strategy, credit union marketers must understand their target audience. You’ll need to conduct market research to identify the needs, preferences, and behaviors of their members. Then, you’ll need to align your digital marketing initiatives with these insights to create personalized and relevant marketing campaigns.

Below, we’ll walk you through this process step by step.

Common Goals of Credit Union Marketing

When developing a digital marketing strategy, it’s essential to have clear goals. Here are the most common goals credit unions focus on.

Attracting New Members

Expanding the member base is vital for the growth and sustainability of any credit union. Digital marketing enables credit unions to reach potential members through targeted online ads, search engine optimization (SEO), and engaging social media campaigns.

Enhancing Customer Retention

Keeping current members satisfied and loyal is just as crucial as attracting new ones. Consider developing digital tools like email marketing, mobile banking apps, and personalized member portals to provide consistent value and convenience.

Improving Member Engagement

An effective strategy fosters meaningful interactions between the credit union and its members. This could include hosting webinars on financial literacy, sharing interactive quizzes or polls on social media, or providing live chat support on the credit union’s website. Increased engagement not only strengthens relationships but encourages members to make use of additional services and products offered.

Differentiating from Competitors

The financial services space is crowded, making differentiation a priority. Credit unions must emphasize their distinctive qualities—whether it’s local involvement, personalized service, or community-centered values—to stand out. Digital storytelling, such as sharing real member testimonials or showcasing community projects, is a powerful way to communicate these differences.

Providing Personalized Experiences

Modern consumers expect a personalized approach, and credit unions are no exception. Using advanced analytics and data-driven insights, credit unions can deliver tailored recommendations, such as offering a first-time mortgage program to young members or promoting retirement planning tools to older demographics. Personalized service reinforces trust and loyalty while demonstrating a genuine understanding of members’ individual needs.

How to Build a Credit Union Digital Marketing Plan

In this section, we’ll walk through the creation phase of the digital marketing plan. Every credit union has its own needs and customers, so choosing the right approach will require research and judgment. These steps can help guide you to your ideal plan.

Step 1: Set Your Objectives and Goals

Before diving into tactics, it’s important to first establish specific, measurable, and relevant goals for your credit union’s digital marketing strategy. These goals not only guide your digital initiatives but also enable you to track and measure success.

While setting these objectives, credit unions should consider both their organizational goals and their members’ needs. For instance, a goal could be to increase website traffic by 20% in the next quarter, which could directly impact member engagement and potentially lead to a rise in loan applications.

Step 2: Define Your Target Audiences

Knowing your audience is paramount in crafting a successful digital marketing strategy for credit unions. This process involves identifying and understanding your member demographics, behavior patterns, motivations, and goals.

Start by collecting demographic data (such as age, location, and profession) about your existing credit union members. Dive into your members’ behavior patterns, like their preferred banking services and the digital platforms they frequently use. Refer to tools like Google Analytics and member surveys to understand your customers’ motivations and needs. For instance, younger members may prefer mobile banking and online loan applications, while older members may focus on retirement planning services.

Tailoring your digital marketing strategy to meet these specific needs can enhance member engagement and satisfaction.

Step 3: Choose Your Channels and Tactics

After defining your target audience, it’s time to select the appropriate online channels and tactics for your digital marketing strategy. This step allows credit unions to effectively reach and engage with their members.

Credit unions should choose channels that their members frequently use, whether it’s social media platforms like Facebook, Instagram, or LinkedIn; email marketing; content marketing through blogs; or online ads.

For example, if a significant portion of your membership engages with email, an email newsletter featuring updates on credit union services, financial tips, and community events can be a practical tactic. Social media might be the best place to connect with and engage younger members with tailored content.

Step 4: Create a Marketing Calendar

Establishing an organized marketing calendar is a key step in your credit union’s digital marketing strategy. This resource helps you plan, coordinate, and track your marketing activities throughout the year.

For credit unions, a well-structured marketing calendar can ensure that all digital marketing initiatives align with important dates, member needs, and organizational goals. For example, you might schedule a campaign promoting auto loans to coincide with a popular car-buying season, or a social media campaign about college loans to align with university application periods. The calendar should be updated regularly and flexible enough to accommodate unexpected changes or opportunities.

Step 5: Track KPIs Using Digital Analytics

To ensure the success of your digital marketing strategy for credit unions, tracking Key Performance Indicators (KPIs) using digital analytics is integral. This process provides insights into how well your digital marketing initiatives are performing and identifies areas for improvement.

Credit unions should select relevant KPIs that align directly with their set objectives and goals. For instance, if your goal is to increase website traffic, your KPI might be the number of unique visitors to your site. Tools like Google Analytics provide granular data on such metrics, enabling you to evaluate your strategy’s effectiveness.

Regularly monitoring and analyzing these KPIs will allow you to adjust your tactics as needed, ensuring your digital marketing strategy remains on track to fulfill your credit union’s goals.

Top Digital Marketing Channels for Credit Unions

So, you understand your customer segments and you’re ready to start targeting their needs. Perfect! Now, let’s dive into the different credit union digital marketing channels that allow you to access these prospects.

Search Engine Optimization (SEO)

Search engine optimization (SEO) is a long-term digital marketing strategy that focuses on enhancing a website’s visibility and ranking on search engine results pages. It involves optimizing your site’s structure, content, and relevance to improve its organic performance on search engines like Google.

Credit union SEO should play a prominent role in your digital marketing strategy. By optimizing your website for search engines, you can enhance your online visibility, attract more website traffic, and ultimately convert prospects into members.

Pay-Per-Click (PPC) Advertising

Pay-per-click (PPC) is a digital marketing model that charges advertisers each time a user clicks on one of their online ads. In essence, it’s a way to buy visits to your site, instead of attempting to earn those visits organically. PPC is a cornerstone of advertising for credit unions in today’s digital-first landscape.

For credit unions, PPC can be an effective tool for targeting ads to specific demographics, such as members looking for personal loan options or mortgages. With a well-optimized PPC campaign, you can boost your credit union’s visibility on search engines, attract new members, and promote their services.

Display Advertising

Display advertising is a form of digital marketing strategy that uses visual graphics such as banners, images, and videos to reach an audience on websites, social media platforms, or apps. In essence, it’s a tool for creating branded visual impressions on digital channels.

Display advertising can increase credit unions’ brand awareness and promote specific services to a targeted audience. For example, a banner ad on a personal finance blog might draw in potential members looking for loan options or further education. To ensure effectiveness, make your display ads relevant, engaging, and in line with the needs of your target demographic.

Social Media Marketing

Social media marketing is a digital marketing strategy that utilizes social media platforms to connect, engage, and build relationships with target audiences. It involves creating and sharing content tailored to your followers’ interests to foster engagement and promote your brand’s offerings.

For credit unions, social media marketing can be an effective tool for reaching younger demographics, who are more likely to use these platforms. By posting content about financial education, community involvement, or exclusive member benefits, you can foster a sense of community and trust.

Content Marketing

Content marketing is a strategic approach for credit unions to focus on creating and distributing valuable, relevant, and consistent content to attract a clearly defined audience. In essence, it’s about providing material that answers your target audience’s questions and fulfills their needs, rather than explicitly promoting a brand.

Credit union digital visitors often seek information on affording specific goal-oriented activities (buying a car, financing a home). This need is currently unmet on a stunning 93% of credit union homepages. By providing this valuable content, credit unions can convert users to purchase quickly and effectively. Website users come away with the positive impression that the credit union cares more about them than itself.

Email Marketing

Email marketing is a digital strategy that involves sending targeted, informative, and promotional messages to a defined audience via email. It’s a direct and personalized way to communicate with your members and potential customers.

For credit unions, email marketing can be a powerful tool for nurturing relationships with members, keeping them informed about new services, community initiatives, and financial advice. However, it’s easy to overwhelm members with excessive communication and get sent to spam. A carefully crafted newsletter shares only relevant information and can keep members engaged, announce new products or services, and share financial tips, helping to strengthen the bond between the credit union and its members.

Video Marketing

Video marketing uses video content to promote your brand, communicate with your audience, and achieve specific marketing goals. It’s a powerful tool nowadays because it can convey messages quickly and memorably. Videos stand out in crowded online spaces, capture attention, and often drive higher engagement compared to text or static images. With platforms like YouTube, Instagram, and TikTok leading the way, video has become a go-to medium for businesses looking to connect with their audience in an authentic and impactful way.

For credit unions, video marketing presents a key opportunity to deepen relationships with members and reach potential new ones. By creating content such as testimonial videos from satisfied members, behind-the-scenes looks at community initiatives, or quick tips on financial literacy, credit unions can showcase their commitment to people over profit. Done right, video marketing can help credit unions build trust, underscore their expertise, and strengthen their community presence.

Community Engagement via Digital Platforms

Digital platforms are great tools for building communities. They provide spaces where organizations can interact directly with their audience, facilitate conversations, and promote shared interests. Social media channels, email campaigns, and video conferencing tools make it easier than ever to connect people across distances, offering the chance to build real connections in virtual spaces. These platforms excel at fostering engagement, whether through live Q&A sessions, interactive polls, or content that encourages discussion and participation. By meeting people where they are—on their phones, tablets, or laptops—digital platforms create opportunities for organizations to engage in meaningful, ongoing dialogue.

Credit unions can use these platforms to strengthen their sense of community. Virtual workshops and webinars on topics like budgeting, saving for college, or understanding credit scores can provide value to members while showcasing the credit union’s expertise. Additionally, community events such as virtual town halls to discuss local support initiatives or online celebrations for milestone achievements bring members together, even when they’re apart. These efforts demonstrate the credit union’s commitment to improving lives beyond financial services, ensuring members feel connected, supported, and heard.

13 Digital Marketing Strategies, Tips, and Ideas for Credit Unions

Now that we’ve explored the different channels of digital marketing for credit unions, let’s delve deeper. Below, we’ll cover some practical strategies, tips, and ideas that credit unions can use to boost their online presence, engage existing members, and attract new membership leads.

Not all strategies work well for all credit unions. It’s important to keep your larger goals in mind and plan ahead. Remember: each tactic you invest in should build towards your larger digital marketing strategy.

1. Optimize Your UI & UX

A well-designed UI ensures consistent, clear, and intuitive navigation across the website, reducing the time members spend learning the site and increasing the time they spend discovering services. Similarly, an optimized UX focuses on understanding and meeting member needs.

This aspect of credit union digital marketing strategy is crucial for providing a seamless online banking experience. Optimizing UI and UX can lead to higher member satisfaction, increased usage of online services, and improved member retention. Digital platforms must be accessible, intuitive, and secure, as these are the key factors that members consider when banking online.

2. Create Multichannel Campaigns

Multichannel campaigns allow credit unions to combine different marketing channels into a seamless customer experience. By coordinating campaigns across channels like email, social media, and direct mail, credit unions can amplify their reach and engagement. For instance, a direct mail campaign could be used to promote online banking services, thus seamlessly converging traditional and digital channels.

3. Provide Interactive Tools and Calculators

Interactive tools and calculators add a dynamic element to your marketing campaigns, offering members practical resources that aid in their financial decision-making process. For instance, credit unions can provide mortgage calculators, loan comparison tools, or savings goal trackers. These tools not only engage the member but also demonstrate the credit union’s commitment to aiding their financial journey.

4. Leverage Retargeted Advertising

Retargeted advertising involves displaying ads to individuals who have previously interacted with your credit union’s digital platforms, enhancing the chance of conversion. This strategy is particularly powerful for reminding potential members about the services or offers they showed interest in, thus nudging them towards finalizing the transaction.

5. Produce Financial Literacy Content

As a financial institution, you’re in a perfect position to share tips and information about personal finance basics. For credit unions, financial literacy content can boost trust, engagement, and loyalty among members by empowering them with knowledge and skills to manage their finances wisely.

6. Run Make-the-Switch Campaigns

Make-the-switch campaigns are strategic initiatives designed to help consumers understand the benefits of credit unions over traditional banking. These campaigns can effectively attract younger demographics by highlighting key advantages such as lower fees, community involvement, and personalized customer service. By emphasizing these aspects, credit unions can encourage potential members to make the valued switch from their current banking institutions.

7. Create Affiliate Partnerships

Affiliate partnerships involve collaborations with businesses or organizations that share similar values or serve a similar audience. For credit unions, these partnerships can be an effective part of a digital marketing strategy. They can help to extend reach, enhance credibility, and offer member-exclusive deals, ultimately driving member satisfaction and loyalty.

8. Focus on Mobile & Online Banking

Mobile and online banking are essential components of a credit union’s digital marketing strategy. About 60% of consumers say they are very or somewhat interested in using a digital bank in the next year. Offering seamless, secure, and user-friendly mobile and online banking services not only aligns with consumer behavior trends but also enhances member satisfaction and loyalty.

9. Run Local Search Ads

Local search ads play a crucial role in enhancing the visibility of credit unions within their local markets. By investing in local search ads, credit unions can boost their performance on Google Maps when potential members search for competitor or “bank” keywords. This strategy is highly effective in reaching local audiences who are actively seeking financial services in their vicinity.

10. Build Geotargeted Landing Pages

Creating geotargeted landing pages allows credit unions to deliver highly relevant content tailored to specific geographic communities. These localized pages can highlight products, services, or promotions that are most useful for members in a particular area, ensuring they feel understood and catered to. By incorporating local keywords, cultural references, or community-specific imagery, geotargeted landing pages enhance engagement and make visitors more likely to trust and interact with the credit union. This strategy not only improves search engine visibility for local audiences but also boosts conversion rates, as the content aligns closely with the unique needs and interests of the target community.

11. Invest in Product and Service Content

Providing clear, user-friendly information about all core offerings helps potential members understand what they stand to gain, aiding their decision-making process. Moreover, it fosters transparency, which is instrumental in building trust and ultimately converting prospective members.

12. Provide Resources and Answer FAQs

Resources and FAQs provide a one-stop solution for potential members to resolve common queries, thereby enhancing their user experience. Meanwhile, a comprehensive resources section can showcase your knowledge and expertise, strengthening trust and credibility among your membership base.

13. Create Digital Loyalty Programs

By rewarding members for their loyalty through discounts, cashback, or exclusive offers, credit unions can enhance member satisfaction and encourage repeat business. This strategy also creates a positive brand image and fosters a sense of community among members.

In-House Marketing vs Hiring an Agency

At the end of the day, there is a difference between reading about effective strategies and actually implementing them. While some organizations can afford the time and cost to develop really effective digital marketing in-house, it can help to bolster your efforts with a dedicated agency.

An experienced agency doesn’t just supplement your efforts—it can become a trusted extension of your team. Skilled agencies bring a wealth of expertise, industry knowledge, and resources that often surpass what internal teams can afford to develop on their own. What’s more, a great agency takes the time to learn the nuances of your credit union, working to understand your goals, challenges, and member base as well as your in-house team. By combining their outside perspective with sharp, data-backed strategies, agencies can uncover fresh ideas and unlock opportunities for growth that might otherwise be overlooked.

At Session Interactive, we’ve built our reputation as a leading digital marketing agency by tailoring our solutions to the unique needs of credit unions, banks, and financial services companies. We understand the fine balance of fostering member trust while driving measurable growth, and we bring the skills and insight to help your organization thrive in a competitive landscape. Collaborating with Session Interactive isn’t about replacing your team—it’s about amplifying your efforts and achieving success together.

Ready to start generating online leads? Get a digital marketing proposal from Session Interactive’s credit union experts.